Xcel Energy 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

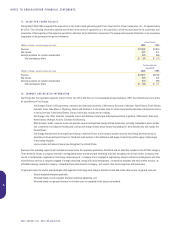

16. REGULATORY ASSETS AND LIABILITIES

Our regulated businesses prepare their financial statements in accordance with the provisions of SFAS71, as discussed in Note 1 to the Financial Statements.

Under SFAS71, regulatory assets and liabilities can be created for amounts that regulators may allow us to collect, or may require us to pay back to customers

in future electric and natural gas rates.

SFAS71 accounting cannot be used by any portion of our business that is not regulated. Efforts to restructure and deregulate the utility industry have

already ended our ability to apply SFAS71 to the generation business of SPS and may further reduce or end our ability to apply SFAS71 in the future.

Write-offs and material changes to our balance sheet, income and cash flows may result.

Restructuring legislation was enacted in the SPS jurisdictions of Texas and New Mexico. See Note 12 to the Financial Statements. When the final PUCT

restructuring order was issued in May 2000, SPS discontinued using SFAS71 accounting for its electric generation business. In the second quarter of 2000,

SPS’ generation-related regulatory assets and other deferred costs were written off. SPS’ electric transmission and distribution businesses continue to meet

the requirements of SFAS71 and are expected to remain regulated.

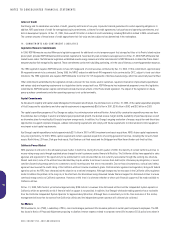

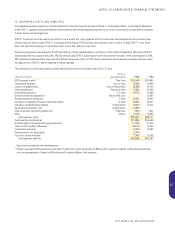

The components of unamortized regulatory assets and liabilities shown on the balance sheet at Dec. 31 were:

Remaining

(Thousands of dollars) Amortization Period 2000 1999

AFDC recorded in plant*Plant Lives $159,406 $184,860

Conservation programs*Up to 5 Years 52,444 40,868

Losses on reacquired debt Term of Related Debt 85,688 84,190

Environmental costs Primarily 9 Years 47,595 48,708

Unrecovered gas costs** 1–2 Years 24,719 15,266

Deferred income tax adjustments Mainly Plant Lives 28,581

Nuclear decommissioning costs 5 Years 54,267 63,835

Employees’ postretirement benefits other than pension 12 Years 46,680 53,321

Employees’ postemployment benefits Undetermined 23,223 23,374

Renewable development costs Undetermined 10,500

State commission accounting adjustments*Plant Lives 7,614 7,641

Other Various 12,125 16,083

Total regulatory assets $524,261 $566,727

Investment tax credit deferrals $119,060 $136,349

Unrealized gains from decommissioning investments 171,736 177,578

Pension costs-regulatory differences 139,178 84,198

Conservation incentives 40,679 25,284

Deferred income tax adjustments 12,416

Fuel costs, refunds and other 11,497 18,795

Total regulatory liabilities $494,566 $442,204

*Earns a return on investment in the ratemaking process.

**Excludes current portion with expected rate recovery within 12 months of $13 million and $8 million for 2000 and 1999, respectively. In addition, excludes other deferred energy

costs also recoverable within 12 months of $270 million and $47 million for 2000 and 1999, respectively.

XCEL ENERGY INC. AND SUBSIDIARIES

63

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS