Xcel Energy 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

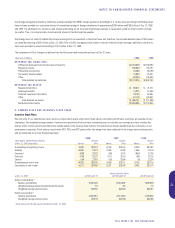

Xcel Energy management intends to indefinitely reinvest earnings from NRG’s foreign operations. Accordingly, U.S. income taxes and foreign withholding taxes

have not been provided on a cumulative amount of unremitted earnings of foreign subsidiaries of approximately $238 million and $195 million at Dec. 31, 2000

and 1999. The additional U.S. income tax and foreign withholding tax on the unremitted foreign earnings, if repatriated, would be offset in part by foreign

tax credits. Thus, it is not practicable to estimate the amount of tax that might be payable.

Xcel Energy does not intend to indefinitely reinvest earnings from its investment in Yorkshire Power and, therefore, has provided deferred taxes of $20 million

on unremitted earnings of $55 million at Dec. 31, 2000. Prior to 2000, management did intend to reinvest Yorkshire Power earnings indefinitely, and thus no

taxes were provided on unremitted earnings of $11 million at Dec. 31, 1999.

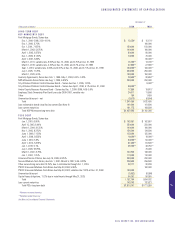

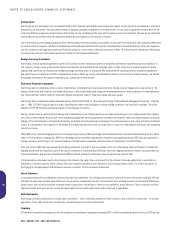

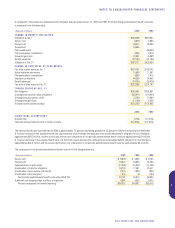

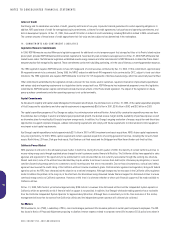

The components of Xcel Energy’s net deferred tax liability (current and noncurrent portions) at Dec. 31 were:

(Thousands of dollars) 2000 1999

DEFERRED TAX LIABILITIES:

Differences between book and tax bases of property $1,754,928 $1,739,394

Regulatory assets 168,380 143,187

Partnership income/loss 70,266 36,756

Tax benefit transfer leases 18,839 23,431

Other 98,263 106,932

Total deferred tax liabilities $2,110,676 $2,049,700

DEFERRED TAX ASSETS:

Regulatory liabilities $ 88,817 $ 71,471

Employee benefits 14,675 13,493

Deferred investment tax credits 76,133 83,061

Other 87,116 103,041

Total deferred tax assets $ 266,741 $ 271,066

Net deferred tax liability $1,843,935 $1,778,634

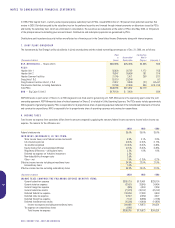

9. COMMON STOCK AND INCENTIVE STOCK PLANS

Incentive Stock Plans

We and some of our subsidiaries have incentive compensation plans under which stock options and other performance incentives are awarded to key

employees. The weighted average number of common and potentially dilutive shares outstanding used to calculate our earnings per share includes the

dilutive effect of stock options and other stock awards based on the treasury stock method. The tables below include awards made by us and some of our

predecessor companies. Stock options issued under NCE, PSCo and SPS plans before the merger have been adjusted for the merger stock exchange ratio

and are presented on an Xcel Energy share basis.

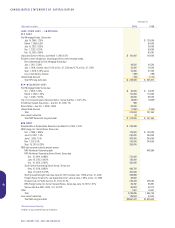

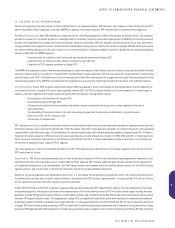

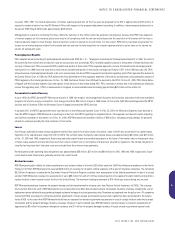

2000 1999 1998

Stock Options and Performance Awards Average Average Average

at Dec. 31, 2000 (Thousands) Awards Price Awards Price Awards Price

Outstanding at beginning of year 8,490 $25.12 6,156 $26.15 5,439 $24.92

Granted 6,980 25.31 2,545 22.64 1,456 29.19

Exercised (453) 20.33 (90) 18.72 (636) 22.36

Forfeited (704) 25.70 (111) 30.10 (94) 28.15

Expired (54) 22.62 (10) 25.64 (9) 23.24

Outstanding at end of year 14,259 $25.35 8,490 $25.12 6,156 $26.15

Exercisable at end of year 8,221 $24.46 5,301 $25.84 4,405 $25.14

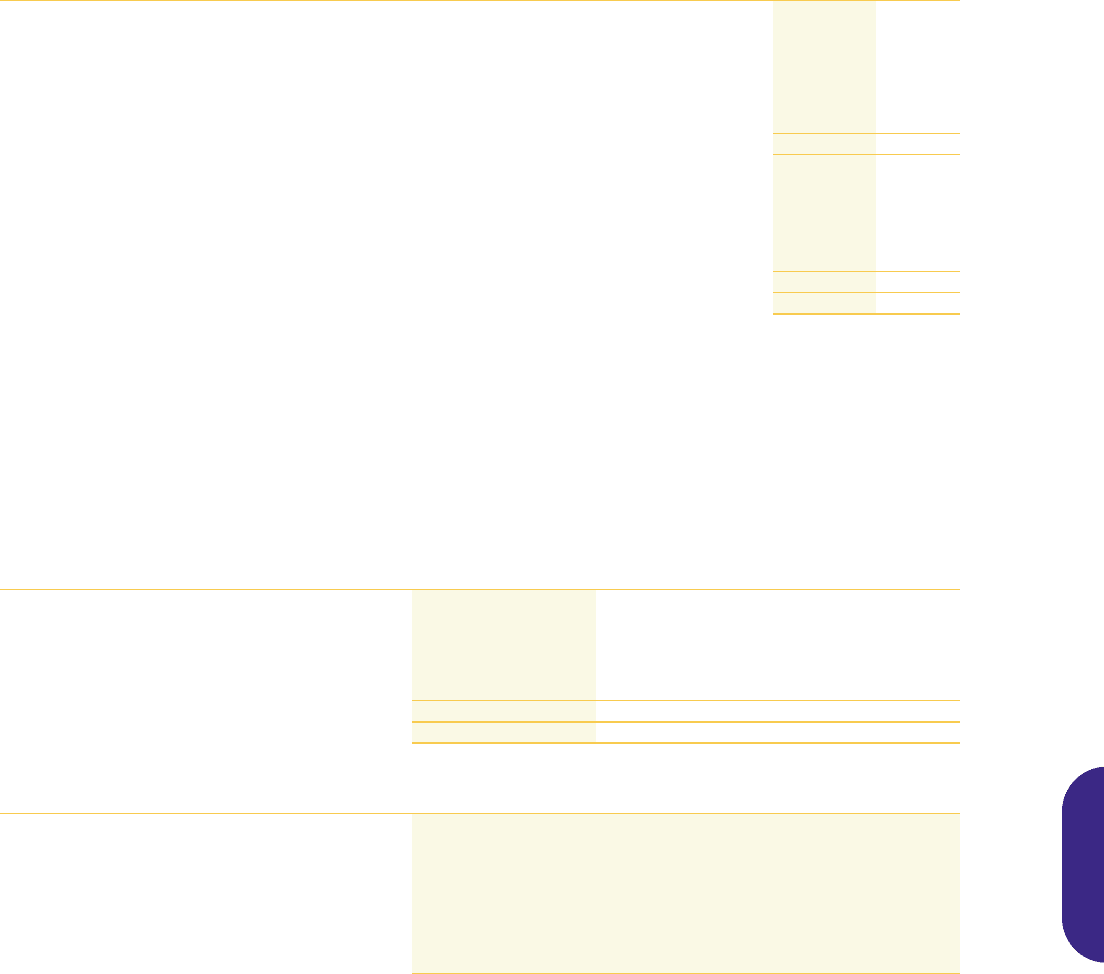

Range of Exercise Prices

at Dec. 31, 2000 $16.60 to $21.75 $22.50 to $27.99 $28.00 to $31.00

Options outstanding:*

Number outstanding 3,245,478 9,616,092 1,388,878

Weighted average remaining contractual life (years) 7.6 8.3 7.4

Weighted average exercise price $19.82 $26.44 $30.67

Options exercisable:*

Number exercisable 2,820,681 4,212,023 1,180,324

Weighted average exercise price $19.78 $25.86 $30.65

*There were also 8,259 other awards outstanding at Dec. 31, 2000.

XCEL ENERGY INC. AND SUBSIDIARIES

47

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS