Xcel Energy 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

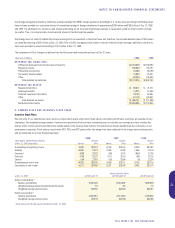

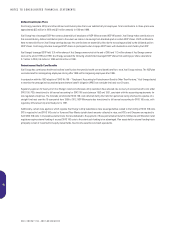

In 1998, PSCo Capital Trust I, a wholly owned, special-purpose subsidiary trust of PSCo, issued $194 million of 7.60 percent trust preferred securities that

mature in 2038. Distributions paid by the subsidiary trust on the preferred securities are financed through interest payments on debentures issued by PSCo

and held by the subsidiary trust, which are eliminated in consolidation. The securities are redeemable at the option of PSCo after May 2003, at 100 percent

of the principal amount outstanding plus accrued interest. Distributions and redemption payments are guaranteed by PSCo.

Distributions paid to preferred security holders are reflected as a financing cost in the Consolidated Income Statements along with interest expense.

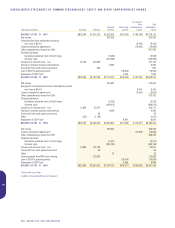

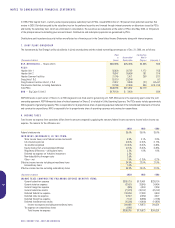

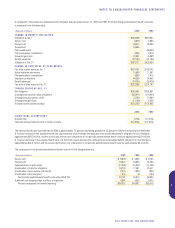

7. JOINT PLANT OWNERSHIP

The investments by Xcel Energy’s utility subsidiaries in jointly owned plants and the related ownership percentages as of Dec. 31, 2000, are as follows:

Plant Construction

in Accumulated Work in

(Thousands of dollars) Service Depreciation Progress Ownership %

NSP-MINNESOTA – Sherco Unit 3 $607,568 $252,096 $1,095 59.0

PSCO:

Hayden Unit 1 82,800 35,767 1,172 75.5

Hayden Unit 2 78,347 39,058 161 37.4

Hayden Common Facilities 27,145 2,071 258 53.1

Craig Units 1 & 2 57,710 29,248 9.7

Craig Common Facilities Units 1, 2 & 3 21,012 8,339 (21) 6.5–9.7

Transmission Facilities, including Substations 81,769 27,349 609 42.0–73.0

Total PSCo $348,783 $141,832 $2,179

NRG – Big Cajun II, Unit 3 $179,100 $ 3,400 58.0

NSP-Minnesota is part owner of Sherco 3, an 860-megawatt coal-fired electric generating unit. NSP-Minnesota is the operating agent under the joint

ownership agreement. NSP-Minnesota’s share of related expenses for Sherco 3 is included in Utility Operating Expenses. The PSCo assets include approximately

320 megawatts of generating capacity. PSCo is responsible for its proportionate share of operating expenses (reflected in the Consolidated Statements of Income)

and construction expenditures. NRG is responsible for its proportionate share of operating expenses and construction expenditures.

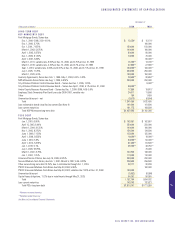

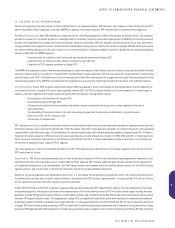

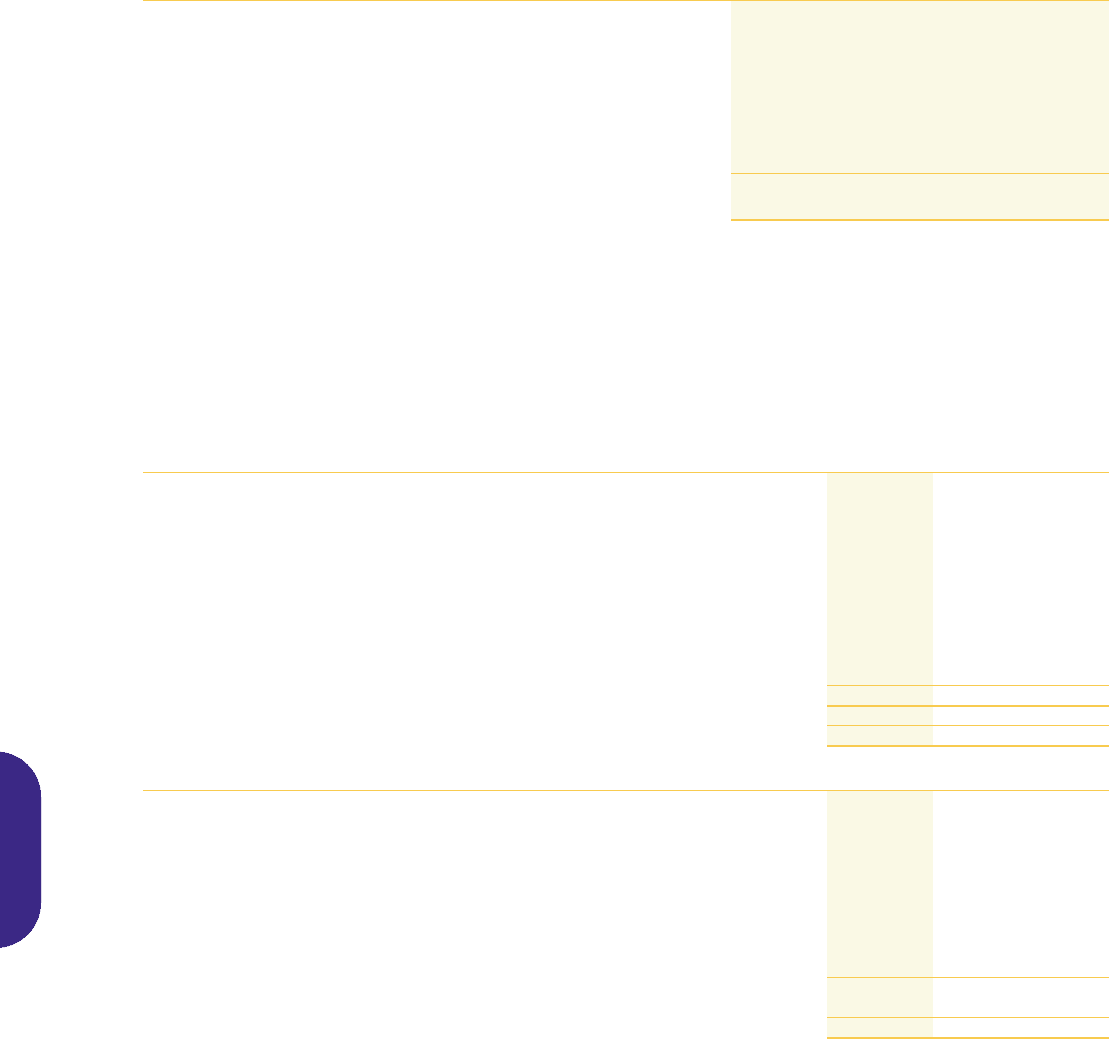

8. INCOME TAXES

Total income tax expense from operations differs from the amount computed by applying the statutory federal income tax rate to income before income tax

expense. The reasons for the difference are:

2000 1999 1998

Federal statutory rate 35.0% 35.0% 35.0%

INCREASES (DECREASES) IN TAX FROM:

State income taxes, net of federal income tax benefit 5.8% 2.1% 2.8%

Life insurance policies (2.4)% (2.3)% (1.7)%

Tax credits recognized (10.2)% (6.0)% (4.6)%

Equity income from unconsolidated affiliates (2.7)% (5.5)% (4.9)%

Regulatory differences – utility plant items 2.3% 1.9% 1.0%

Deferred tax expense on Yorkshire investment 2.3%

Non-deductibility of merger costs 2.9%

Other – net 1.8% (1.3)% 0.2%

Effective income tax rate including extraordinary items 34.8% 23.9% 27.8%

Extraordinary items 1.0%

Effective income tax rate excluding extraordinary items 35.8% 23.9% 27.8%

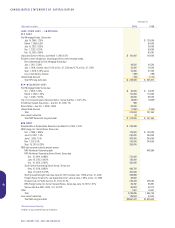

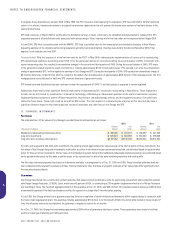

(Thousands of dollars) 2000 1999 1998

INCOME TAXES COMPRISE THE FOLLOWING EXPENSE (BENEFIT) ITEMS:

Current federal tax expense $205,718 $175,461 $238,124

Current state tax expense 63,428 26,949 34,454

Current foreign tax expense (625) 4,040 2,358

Current federal tax credits (71,270) (30,137) (25,122)

Deferred federal tax expense 103,258 27,380 9,940

Deferred state tax expense 12,547 (2,352) 3,027

Deferred foreign tax expense 7,104 (6,868) (7,736)

Deferred investment tax credits (15,295) (14,800) (14,654)

Income tax expense excluding extraordinary items 304,865 179,673 240,391

Tax expense on extraordinary items 8,549

Total income tax expense $296,316 $179,673 $240,391

46

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS