Xcel Energy 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

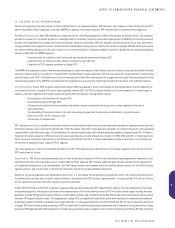

tax years 1993–1997. The total disallowance of interest expense deductions for the five years as proposed by the IRS is approximately $175 million. A

request for technical advice from the IRS National Office with respect to the proposed adjustment is pending. In addition, interest expense deductions for

the period 1998 through 2000 totals approximately $168 million.

Management is vigorously contesting this issue. While the outcome of this matter cannot be predicted, management believes that PSRI’s tax deduction

of interest expense on life insurance policy loans was in full compliance with the tax law and believes that the resolution of this matter will not have a

material adverse impact on Xcel Energy’s financial position, results of operations or cash flows. For this reason, PSRI has not recorded any provision for

income tax or interest expense related to this matter and has continued to take deductions for interest expense related to policy loans on its income tax

returns for subsequent years.

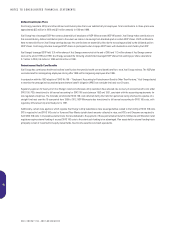

Postemployment Benefits

PSCo adopted accrual accounting for postemployment benefits under SFAS No. 112 – “Employers’ Accounting for Postemployment Benefits” in 1994. The costs of

these benefits were historically recorded on a pay-as-you-go basis and, accordingly, PSCo recorded regulatory assets in anticipation of obtaining future rate

recovery of these costs. PSCo recovered its FERC jurisdictional portion of these costs. PSCo requested approval to recover its Colorado retail natural gas jurisdic-

tional portion in a 1996 retail rate case and its retail electric jurisdictional portion in the electric earnings test filing for 1997. In the 1996 rate case, the CPUC

allowed recovery of postemployment benefit costs on an accrual basis, but denied PSCo’s request to amortize the regulatory asset. PSCo appealed this decision to

the Denver District Court. In 1998, the CPUC deferred the final determination of the regulatory treatment of the electric jurisdictional costs pending the outcome of

PSCo’s appeals on the natural gas rate case. On Dec. 16, 1999, the Denver District Court affirmed the decision by the CPUC. On Jan. 31, 2000, PSCo filed a Notice

of Appeal with the Colorado Supreme Court and expects a final decision on this matter during 2001. PSCo continues to believe that it will ultimately be allowed to

recover this regulatory asset. If PSCo is unsuccessful in its appeal, all unrecoverable amounts totaling approximately $23 million will be written off.

Conservation Incentive Recovery

In June 1999, the MPUC denied NSP-Minnesota recovery of 1998 lost margins, load management discounts and incentives associated with state-mandated

programs for electric energy conservation. Xcel Energy recorded a $35 million charge in 1999 based on this action. NSP-Minnesota appealed the MPUC

decision and in December 2000, the Minnesota Court of Appeals reversed the MPUC decision.

In January 2001, the MPUC appealed the lower court decision to the Minnesota Supreme Court. On Feb. 23, 2001, the Minnesota Supreme Court declined to

hear the MPUC’s appeal. NSP-Minnesota is awaiting an order from the MPUC regarding the implementation of the appeals court decision before adjusting

any liabilities recorded for this matter. As of Dec. 31, 2000, NSP-Minnesota had recorded a liability of $40 million, including carrying charges, for potential

refunds to customers pending the final resolution of this matter.

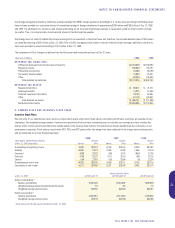

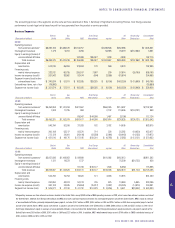

Leases

Xcel Energy’s subsidiaries lease various equipment and facilities used in the normal course of business, some of which are accounted for as capital leases.

Expiration of the capital leases range from 2010 to 2029. The net book value of property under capital leases was approximately $55 million and $57 million

at Dec. 31, 2000 and 1999, respectively. Assets acquired under capital leases are recorded as property at the lower of fair-market value or the present value

of future lease payments and are amortized over their actual contract term in accordance with practices allowed by regulators. The related obligation is

classified as long-term debt. Executory costs are excluded from the minimum lease payments.

Rental expense under operating lease obligations was approximately $56 million, $57 million and $49 million for 2000, 1999 and 1998, respectively. Future

commitments under these leases generally decline from current levels.

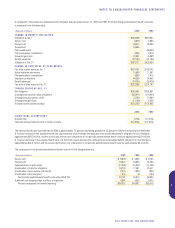

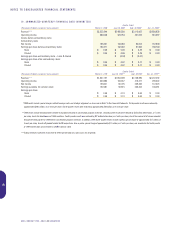

Nuclear Insurance

NSP-Minnesota’s public liability for claims resulting from any nuclear incident is limited to $9.5 billion under the 1988 Price-Anderson amendment to the Atomic

Energy Act of 1954. NSP-Minnesota has secured $200 million of coverage for its public liability exposure with a pool of insurance companies. The remaining

$9.3 billion of exposure is funded by the Secondary Financial Protection Program, available from assessments by the federal government in case of a nuclear

accident. NSP-Minnesota is subject to assessments of up to $88 million for each of its three licensed reactors to be applied for public liability arising from a

nuclear incident at any licensed nuclear facility in the United States. The maximum funding requirement is $10 million per reactor during any one year.

NSP-Minnesota purchases insurance for property damage and site decontamination cleanup costs from Nuclear Electric Insurance Ltd. (NEIL). The coverage

limits are $1.5 billion for each of NSP-Minnesota’s two nuclear plant sites. NEIL also provides business interruption insurance coverage, including the cost of

replacement power obtained during certain prolonged accidental outages of nuclear generating units. Premiums are expensed over the policy term. All companies

insured with NEIL are subject to retroactive premium adjustments if losses exceed accumulated reserve funds. Capital has been accumulated in the reserve

funds of NEIL to the extent that NSP-Minnesota would have no exposure for retroactive premium assessments in case of a single incident under the business

interruption and the property damage insurance coverage. However, in each calendar year, NSP-Minnesota could be subject to maximum assessments of

approximately $3 million for business interruption insurance and $11 million for property damage insurance if losses exceed accumulated reserve funds.

XCEL ENERGY INC. AND SUBSIDIARIES

57

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS