Xcel Energy 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

CONTENTS: PAGE 33 – CONSOLIDATED FINANCIAL

STATEMENTS, PAGE 40 – NOTES TO FINANCIAL

STATEMENTS, PAGE 67 – SHAREHOLDER

INFORMATION

XCEL ENERGY 2000 ANNUAL REPORT

Table of contents

-

Page 1

C O N T E N T S : P A G E 3 3 - C O N S O L I D AT E D F I N A N C I A L S TAT E M E N T S , P A G E 4 0 - N O T E S T O F I N A N C I A L STATEMENTS, INFORMATION PAGE 67 - SHAREHOLDER

XCEL ENERGY 2000 ANNUAL REPORT

-

Page 2

...President and Chief Financial Officer

Xcel Energy Inc. Minneapolis, Minnesota March 2, 2001

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS

To Xcel Energy Inc.: We have audited the accompanying consolidated balance sheets and statements of capitalization of Xcel Energy Inc. (a Minnesota corporation) and...

-

Page 3

REPORTS OF MANAGEMENT AND INDEPENDENT PUBLIC ACCOUNTANTS

REPORTS OF INDEPENDENT PUBLIC ACCOUNTANTS

To the Board of Directors and Stockholders of NRG Energy, Inc.: In our opinion, the consolidated balance sheet and the related consolidated statements of income, of stockholders' equity and cash ...

-

Page 4

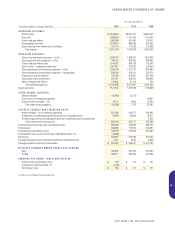

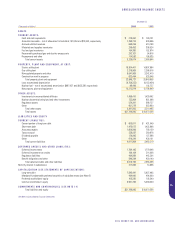

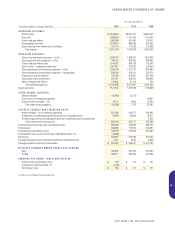

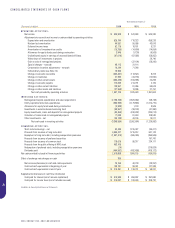

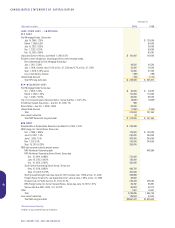

... capitalized Distributions on redeemable preferred securities of subsidiary trusts Dividend requirements and redemption premium on preferred stock of subsidiaries Total interest and financing costs Income before income taxes and extraordinary items Income taxes Income before extraordinary items...

-

Page 5

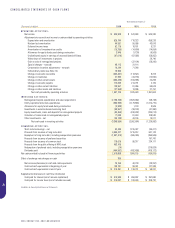

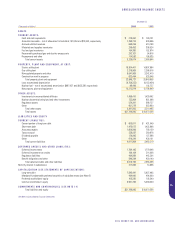

... capital expenditures and asset acquisitions Utility capital/construction expenditures Allowance for equity funds used during construction Investments in external decommissioning fund Equity investments, loans and deposits for nonregulated projects Collection of loans made to nonregulated projects...

-

Page 6

... tax credits Regulatory liabilities Benefit obligations and other Total deferred credits and other liabilities Minority interest in subsidiaries

CAPITALIZATION (SEE STATEMENTS OF CAPITALIZATION):

Long-term debt Mandatorily redeemable preferred securities of subsidiary trusts (see Note 6) Preferred...

-

Page 7

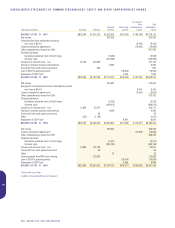

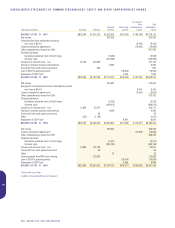

... income for 2000 Dividends declared: Cumulative preferred stock of Xcel Energy Common stock Issuances of common stock - net Tax benefit from stock options exercised Other Gain recognized from NRG stock offering Loan to ESOP to purchase shares Repayment of ESOP loan*

BALANCE AT DEC. 31, 2000

*Did not...

-

Page 8

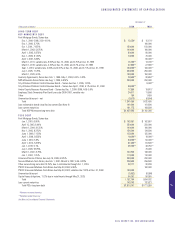

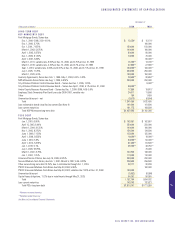

... County Resource Recovery Bond - Series due Dec. 1, 2000-2008, 4.05-5.0% Employee Stock Ownership Plan Bank Loans due 2000-2007, variable rate Other Unamortized discount - net Total Less redeemable bonds classified as current (See Note 4) Less current maturities Total NSP-Minnesota long-term debt...

-

Page 9

..., 2024, 9.479% Sterling Luxembourg #3 Loan due June 30, 2019, variable rate, 7.86% at Dec. 31, 2000 Flinders Power Finance Pty. due September 2012, various rates, 7.58% at Dec. 31, 2000 Crockett Corp. LLP debt due Dec. 31, 2014, 8.13% NRG Energy Center, Inc. Senior Secured Notes, Series due June 15...

-

Page 10

...discount Total Xcel Energy Inc. debt Total long-term debt

M A N D AT O R I LY R E D E E M A B L E P R E F E R R E D S E C U R I T I E S O F S U B S I D I A R Y T R U S T S

$5,827,485

Each holding as its sole asset junior subordinated deferrable debentures of NSP-Minnesota, PSCo and SPS - (see Note...

-

Page 11

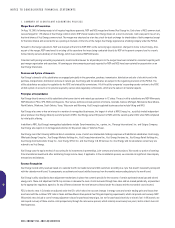

... Xcel Energy directly owns six utility subsidiaries that serve electric and natural gas customers in 12 states. These six utility subsidiaries are NSP-Minnesota, NSP-Wisconsin, PSCo, SPS, BMG and Cheyenne. Their service territories include portions of Arizona, Colorado, Kansas, Michigan, Minnesota...

-

Page 12

... certain level are returned to the customer. NSP-Minnesota and PSCo's rates include monthly adjustments for the recovery of conservation and energy management program costs, which are reviewed annually. Trading Operations Effective with year-end 2000 reporting, Xcel Energy changed its policy for the...

-

Page 13

... when the hedging instrument relates to a project that has financial statements that are not consolidated into NRG's financial statements. Otherwise, they are reported as a part of debt. A final derivative instrument used by Xcel Energy is the interest rate swap. The cost or benefit of the interest...

-

Page 14

... Stock-Based Employee Compensation Xcel Energy has several stock-based compensation plans. We account for those plans using the intrinsic value method. We do not record compensation expense for stock options because there is no difference between the market price and the purchase price at grant date...

-

Page 15

... in the form of bank loans and letters of credit, but its primary purpose is support for commercial paper borrowings. In July 2000, PSCo and its subsidiary, Public Service of Colorado Credit Corporation (PSCCC), entered into a $600 million, 364-day revolving credit agreement that provides for direct...

-

Page 16

... are contracts between the companies and their bond holders. In addition, certain SPS payments under its pollution control obligations are pledged to secure obligations of the Red River Authority of Texas. The annual sinking-fund requirements of Xcel Energy's utility subsidiaries' first mortgage...

-

Page 17

... taxes, net of federal income tax benefit Life insurance policies Tax credits recognized Equity income from unconsolidated affiliates Regulatory differences - utility plant items Deferred tax expense on Yorkshire investment Non-deductibility of merger costs Other - net Effective income tax rate...

-

Page 18

... for the merger stock exchange ratio and are presented on an Xcel Energy share basis.

2000

Stock Options and Performance Awards at Dec. 31, 2000 (Thousands) Awards Average Price Awards

1999

Average Price Awards

1998

Average Price

Outstanding at beginning of year Granted Exercised Forfeited...

-

Page 19

... determined pension costs recognized for ratemaking and financial reporting purposes, subject to the limitations of applicable employee benefit and tax laws. Plan assets principally consist of the common stock of public companies, corporate bonds and U.S. government securities.

XCEL ENERGY INC. AND...

-

Page 20

... and 1999, for all Xcel Energy plans on a combined basis is presented in the following table.

(Thousands of dollars)

2000

1999

CHANGE IN BENEFIT OBLIGATION

Obligation at Jan. 1 Service cost Interest cost Acquisitions Plan amendments Actuarial (gain) loss Benefit payments Obligation at Dec. 31...

-

Page 21

... 106 costs. SPS is required to fund SFAS 106 costs for Texas and New Mexico jurisdictional amounts collected in rates, and PSCo and Cheyenne are required to fund SFAS 106 costs in irrevocable external trusts that are dedicated to the payment of these postretirement benefits. Minnesota and Wisconsin...

-

Page 22

...all Xcel Energy postretirement health care plans is presented in the following table.

(Thousands of dollars)

2000

1999

CHANGE IN BENEFIT OBLIGATION

Obligation at Jan. 1 Service cost Interest cost Acquisitions Plan amendments Plan participants' contributions Actuarial (gain) loss Benefit payments...

-

Page 23

... of unconsolidated affiliates as equity earnings. A summary of Xcel Energy's significant equity method investments is listed in the following table.

Name Geographic Area Economic Interest

Loy Yang Power A Enfield Energy Centre Yorkshire Power Gladstone Power Station COBEE (Bolivian Power Co. Ltd...

-

Page 24

... test through 2001; A 6-percent rate reduction for those residential and small commercial customers who choose not to switch suppliers at the start of retail competition; The unbundling of business activities, costs and rates relating to generation, transmission and distribution, and retail services...

-

Page 25

... redeemable preferred securities are estimated based on the quoted market prices for the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality. The fair-value estimates presented are based on information available to management as of Dec. 31, 2000...

-

Page 26

...maturity of March 2014. The loan was incurred for the development and construction of an underground natural gas storage facility in northeastern Colorado. Separately, Xcel Energy has guaranteed up to $4.5 million to cover costs of expenses related to the project. NSP-Minnesota has sold a portion of...

-

Page 27

... pay obligations, or would consider discontinuing energy service to customers to avoid incurring costs that are not recoverable. Due to these circumstances, various bond rating agencies have lowered the credit rating of the California utilities to below investment grade. California state agencies...

-

Page 28

... NSP-Minnesota has secured $200 million of coverage for its public liability exposure with a pool of insurance companies. The remaining $9.3 billion of exposure is funded by the Secondary Financial Protection Program, available from assessments by the federal government in case of a nuclear accident...

-

Page 29

...-Minnesota's 2000 electric system capability. The risk of loss from nonperformance by Manitoba Hydro is not considered significant, and the risk of loss from market price changes is mitigated through cost-of-energy rate adjustments. At Dec. 31, 2000, the estimated future payments for capacity that...

-

Page 30

...expect that the Public Service Commission of Wisconsin (PSCW) will continue to allow NSP-Wisconsin to recover payments for environmental remediation from its customers. The PSCW has consistently authorized recovery in NSP-Wisconsin rates of all remediation costs incurred at the Ashland site, and has...

-

Page 31

... Plan for calendar years 1998-2001. Plant Emissions In 1996, a conservation organization filed a complaint in the U.S. District Court pursuant to provisions of the Clean Air Act against the joint owners of the Craig Steam Electric Generating Station, located in western Colorado. Tri-State Generation...

-

Page 32

...NSP-Minnesota has funded its portion of the DOE's permanent disposal program since 1981. The fuel disposal fees are based on a charge of 0.1 cent per kilowatt-hour sold to customers from nuclear generation. Fuel expense includes DOE fuel disposal assessments of approximately $12 million in 2000, $12...

-

Page 33

...income securities, such as tax-exempt municipal bonds and U.S. government securities that mature in 1 to 20 years, and common stock of public companies. We plan to reinvest matured securities until decommissioning begins. At Dec. 31, 2000, NSP-Minnesota had recorded and recovered in rates cumulative...

-

Page 34

... Unrecovered gas costs** Deferred income tax adjustments Nuclear decommissioning costs Employees' postretirement benefits other than pension Employees' postemployment benefits Renewable development costs State commission accounting adjustments* Other Total regulatory assets Investment tax credit...

-

Page 35

... natural gas and propane primarily in portions of Minnesota, Wisconsin, North Dakota, Michigan, Arizona, Colorado and Wyoming. NRG develops, builds, acquires, owns and operates several nonregulated energy-related businesses, including independent power production, commercial and industrial heating...

-

Page 36

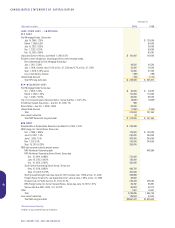

...Thousands of dollars) Electric Utility Gas Utility NRG Xcel Energy International e prime All Other Reconciling Eliminations Consolidated Total

2000

Operating revenues from external customers* Intersegment revenues Equity in earnings (losses) of unconsolidated affiliates Total revenues Depreciation...

-

Page 37

...stock Earnings per share: Basic Diluted

$1,807,157 300,960 153,621 152,561 $ $ 0.46 0.46

$1,654,399 184,337 60,725 58,615 $ $ 0.18 0.18

$2,146,695 418,277 209,264 208,204 $ $ 0.63 0.63

$2,207,292 298,322 147,323 146,261 $ $ 0.43 0.43

*2000 results include special charges related to merger costs...

-

Page 38

...Headquarters 800 Nicollet Mall, Minneapolis, MN 55402 Internet Address http://www.xcelenergy.com Shareholders Information Contact Wells Fargo Shareowners Services (Xcel Energy Inc. stock transfer agent) toll free at 1-877-778-6786. Xcel Energy Direct Purchase Plan Xcel Energy's Direct Purchase Plan...

-

Page 39

...Xcel Energy Inc. Transfer Agent, Registrar, Dividend Distribution, Common and Preferred Stocks Wells Fargo Bank Minnesota, N.A.,161 North Concord Exchange, South St. Paul, MN 55075 Trustee-Bonds Wells Fargo Bank Minnesota, N.A., Sixth St. and Marquette Ave., Minneapolis, MN 55479-0059 Coupon Paying...

-

Page 40

...the merger.

XCEL ENERGY PRINCIPAL OFFICERS

Paul J. Bonavia President - Energy Markets Wayne H. Brunetti President and Chief Executive Officer Cathy J. Hart Vice President and Corporate Secretary

James J. Howard Chairman Gary R. Johnson Vice President and General Counsel Richard C. Kelly President...