WeightWatchers 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

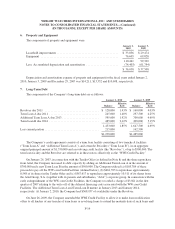

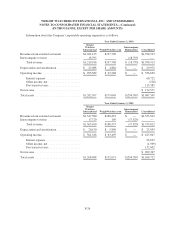

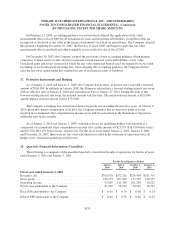

13. Cash Flow Information

January 2,

2010

January 3,

2009

December 29,

2007

Net cash paid during the year for:

Interest expense ............................................ $81,968 $ 96,556 $93,595

Income taxes .............................................. $86,081 $132,648 $89,536

Noncash investing and

financing activities were as follows:

Fair value of net assets/(liabilities) acquired in

connection with acquisitions ................................ $ — $ 345 $ (326)

Dividends declared but not yet paid at year-end ....................... $13,786 $ 13,876 $14,233

14. Commitments and Contingencies

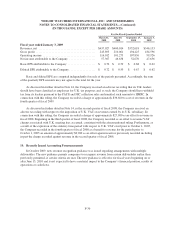

U.K. VAT Matter

In June 2008, the U.K. Court of Appeal issued a ruling that that from April 1, 2005 Weight Watchers

meeting fees in the United Kingdom were fully subject to 17.5% standard rated value added tax (“VAT”) thus

reversing in its entirety an earlier 2007 decision of the U.K. VAT and Duties Tribunal (the “VAT Tribunal”) in

the Company’s favor. For over a decade prior to April 1, 2005, Her Majesty’s Revenue and Customs (“HMRC”)

had determined that Weight Watchers meeting fees in the United Kingdom were only partially subject to 17.5%

VAT. In light of the Court of Appeal’s ruling and in accordance with accounting guidance for contingencies, the

Company recorded a charge of approximately $32.5 million as an offset to revenue in the second quarter of fiscal

2008 for U.K. VAT liability (including interest) in excess of reserves previously recorded. Beginning in the third

quarter of fiscal 2008, in accordance with accounting guidance for contingencies, the Company has recorded as

an offset to revenue VAT charges associated with U.K. meeting fees as earned, consistent with the Court of

Appeal’s ruling.

However, with respect to U.K. VAT owed for the period prior to July 1, 2005, HMRC has failed to raise a

notice of assessment within the statutory three-year time period. In addition, although HMRC raised notices of

assessment against the Company with respect to U.K. VAT due for the periods July 1, 2005 to September 30,

2005 and October 1, 2005 to December 31, 2005, the Company has asserted that these notices of assessment are

invalid on the grounds that they had been raised outside the relevant statutory time limits. HMRC indicated in

November 2008 that it agreed with the Company’s assertion that the notice of assessment for the period July 1,

2005 to September 30, 2005 was invalid, and, in February 2009, confirmed that this notice had been formally

withdrawn. As a result of the expiration of the statutory time period with respect to U.K. VAT owed prior to

October 1, 2005, the Company recorded in the fourth quarter of fiscal 2008 as a benefit to revenue for the periods

prior to October 1, 2005 an amount of approximately $9.2 million as an offset against reserves previously

recorded including in part the charge recorded against revenue in the second quarter of fiscal 2008 for U.K. VAT

liability.

In March 2009, June 2009 and September 2009, HMRC raised notices of assessment against the Company

in respect of U.K. VAT due for the periods January 1, 2006 to March 31, 2006, April 1, 2006 to June 30, 2006,

and July 1, 2006 to September 30, 2006, respectively, which the Company similarly believes were raised outside

the relevant statutory time limits. The Company intends to vigorously challenge any amount of U.K. VAT that

HMRC claims to be owed by the Company for any period between October 1, 2005 and September 30, 2006.

F-23