WeightWatchers 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On December 31, 2006, the first day of fiscal 2007, the Company adopted new accounting guidance

governing the recognition and measurement of tax positions taken or expected to be taken in a tax return. For

those benefits to be recognized, a tax position must be more likely than not to be sustained upon examination by

taxing authorities. The amount recognized is measured as the largest amount of benefit that is greater than 50

percent likely of being realized upon ultimate settlement. As a result of the December 31, 2006 adoption of this

accounting guidance, the Company increased its tax liability for unrecognized tax benefits by $1.9 million, which

was accounted for as a reduction to the opening balance of retained earnings for fiscal 2007.

Capitalized Software Development

We capitalize certain software costs incurred in connection with developing or obtaining software for

internal use. These costs are amortized over a period of three to five years, the estimated useful life of the

software. We periodically evaluate for impairment capitalized software development costs by considering,

among other factors, whether the software is still expected to provide substantive service potential, and whether a

significant change is being made or will be made to the software.

Share-Based Compensation

On January 1, 2006, we adopted accounting guidance on share-based compensation and began recognizing

the cost of all share-based awards based on their estimated grant-date fair value over the related service period of

such awards. Upon adoption of this accounting guidance, we elected to apply the modified prospective transition

method to all past awards outstanding and unvested as of the date of adoption and began recognizing the

associated expense over the remaining vesting period based on the fair values previously determined and

disclosed as part of our pro forma disclosures. We have not restated the results of prior periods.

The fair value of restricted stock units and vested shares is determined by the market price of our common

stock on the date of grant. The fair value of option awards is estimated on the date of grant using the Black-

Scholes option pricing model, which requires estimates of the expected term of the option, the expected volatility

of the Company’s stock price, the risk-free interest rate and the expected dividend yield. We recognize expense

for all share-based awards based on the fair value of the number of awards we estimate will fully vest. A change

in these underlying assumptions will cause a change in the estimated fair value of share-based awards and the

underlying expense recorded. We continue to evaluate these estimates and assumptions and believe that these

assumptions are appropriate.

Results of Operations

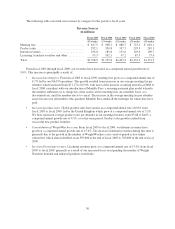

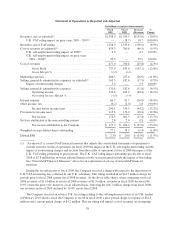

Comparison of Fiscal 2009 (52 weeks) to Fiscal 2008 (53 weeks)

Two adverse U.K. tax rulings caused the Company to record prior period adjustments that negatively

impacted certain key metrics in both fiscal 2009 and fiscal 2008. We discuss these U.K. rulings in further detail

in “Item 3. Legal Proceedings—U.K. Self-Employment Matter and—U.K. VAT Matter” in Part I of this Annual

Report on Form 10-K. The table below shows our consolidated results for fiscal 2009 versus fiscal 2008 on both

a GAAP basis and on an adjusted basis to show the impact of these rulings on both years and to exclude the

restructuring charges associated with our cost savings initiatives in fiscal 2009.

37