WeightWatchers 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

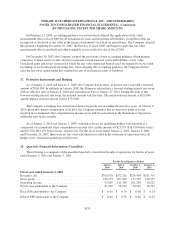

On February 12, 2008, accounting guidance was issued which delayed the application of fair value

measurement rules to fiscal 2009 for all non-financial assets and non-financial liabilities, except those that are

recognized or disclosed at fair value in the financial statements on at least an annual basis. The Company adopted

this guidance beginning December 30, 2007, the first day of fiscal 2008, and began to apply the fair value

measurement rules to goodwill and other intangible assets on the first day of fiscal 2009.

On December 30, 2007, the Company adopted the provisions of new accounting guidance which permits

companies to make an irrevocable election to measure certain financial assets and liabilities at fair value.

Unrealized gains and losses on items for which the fair value option has been elected are required to be recorded

in earnings at each subsequent reporting date. Upon adopting this accounting guidance, the Company did not

elect the fair value option under this standard for any of its financial assets or liabilities.

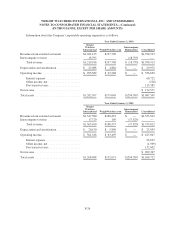

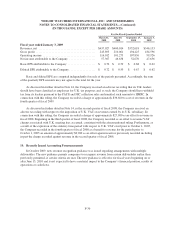

17. Derivative Instruments and Hedging

As of January 2, 2010 and January 3, 2009, the Company had in effect an interest rate swap with a notional

amount of $900,000. In addition, in January 2009, the Company entered into a forward-starting interest rate swap

with an effective date of January 4, 2010 and a termination date of January 27, 2014. During the term of this

forward-starting interest rate swap, the notional amount will fluctuate. The initial notional amount is $425,000

and the highest notional amount will be $755,000.

The Company is hedging forecasted transactions for periods not exceeding the next five years. At January 2,

2010, given the current configuration of its debt, the Company estimates that no derivative gains or losses

reported in accumulated other comprehensive income (loss) will be reclassified to the Statement of Operations

within the next twelve months.

As of January 2, 2010 and January 3, 2009, cumulative losses for qualifying hedges were reported as a

component of accumulated other comprehensive income (loss) in the amounts of $23,735 ($38,910 before taxes)

and $37,326 ($61,193 before taxes), respectively. For the fiscal years ended January 2, 2010, January 3, 2009

and December 29, 2007, there were no fair value adjustments recorded in the statement of operations since all

hedges were considered qualifying and effective.

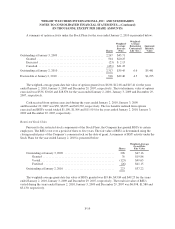

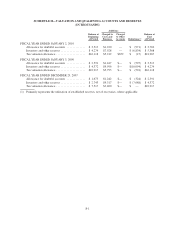

18. Quarterly Financial Information (Unaudited)

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended January 2, 2010 and January 3, 2009.

For the Fiscal Quarters Ended

April 4,

2009

July 4,

2009

October 3,

2009

January 2,

2010

Fiscal year ended January 2, 2010

Revenues, net ......................................... $390,578 $372,526 $324,494 $311,315

Gross profit ........................................... 212,173 207,469 177,995 130,337

Operating income ...................................... 93,845 111,340 101,240 50,225

Net income attributable to the Company .................... 47,306 58,762 52,569 18,707

Basic EPS attributable to the Company ..................... $ 0.61 $ 0.76 $ 0.68 $ 0.24

Diluted EPS attributable to the Company .................... $ 0.61 $ 0.76 $ 0.68 $ 0.24

F-29