WeightWatchers 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

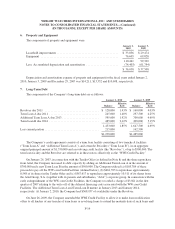

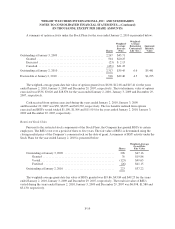

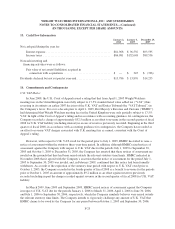

A summary of option activity under the Stock Plans for the year ended January 2, 2010 is presented below:

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life (Yrs.)

Aggregate

Intrinsic

Value

Outstanding at January 3, 2009 ............................... 2,267 $43.71

Granted ............................................. 504 $20.25

Exercised ............................................ (23) $ 2.13

Canceled ............................................ (431) $41.43

Outstanding at January 2, 2010 ............................... 2,317 $39.45 6.6 $5,441

Exercisable at January 2, 2010 ............................... 916 $42.46 4.3 $1,195

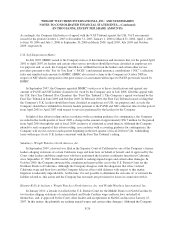

The weighted-average grant-date fair value of options granted was $6.00, $12.08 and $15.41 for the years

ended January 2, 2010, January 3, 2009 and December 29, 2007, respectively. The total intrinsic value of options

exercised was $536, $3,026 and $28,876 for the years ended January 2, 2010, January 3, 2009 and December 29,

2007, respectively.

Cash received from options exercised during the years ended January 2, 2010, January 3, 2009

and December 29, 2007 was $50, $8,075 and $18,563, respectively. The tax benefits realized from options

exercised and RSUs vested totaled $1,190, $1,504 and $11,919 for the years ended January 2, 2010, January 3,

2009 and December 29, 2007, respectively.

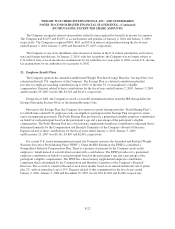

Restricted Stock Units

Pursuant to the restricted stock components of the Stock Plans, the Company has granted RSUs to certain

employees. The RSUs vest over a period of three to five years. The fair value of RSUs is determined using the

closing market price of the Company’s common stock on the date of grant. A summary of RSU activity under the

Stock Plans for the year ended January 2, 2010 is presented below:

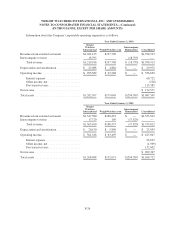

Shares

Weighted-Average

Grant-Date

Fair Value

Outstanding at January 3, 2009 .................................. 296 $47.16

Granted ................................................. 76 $19.86

Vested .................................................. (123) $49.63

Forfeited ................................................ (26) $41.15

Outstanding at January 2, 2010 .................................. 223 $37.22

The weighted-average grant-date fair value of RSUs granted was $19.86, $43.84 and $49.25 for the years

ended January 2, 2010, January 3, 2009 and December 29, 2007, respectively. The total fair value of RSUs

vested during the years ended January 2, 2010, January 3, 2009 and December 29, 2007 was $6,098, $1,580 and

$3,130, respectively.

F-19