WeightWatchers 2009 Annual Report Download - page 82

Download and view the complete annual report

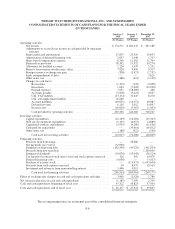

Please find page 82 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

same time payment is received from the customer. Revenue from meeting fees, product sales, commissions and

royalties is recognized when services are rendered, products are shipped to customers and title and risk of loss

pass to the customer, and commissions and royalties are earned. Advertising revenue is recognized when

advertisements are published. Revenue from magazine sales is recognized when the magazine is sent to the

customer. Deferred revenue, consisting of prepaid meeting fees, such as Monthly Pass, and magazine

subscription revenue, is amortized into revenue over the period earned. Discounts to customers, including free

registration offers, are recorded as a deduction from gross revenue in the period such revenue was recognized.

WeightWatchers.com primarily generates revenue from monthly Internet subscriptions. Subscription fee

revenues are recognized over the period that products are provided. One time sign up fees are deferred and

recognized over the expected customer relationship period. Subscription fee revenues that are paid in advance are

deferred and recognized on a straight-line basis over the subscription period.

The Company grants refunds in aggregate amounts that historically have not been material. Because the

period of payment of the refund generally approximates the period revenue was originally recognized, refunds

are recorded as a reduction of revenue when paid.

Advertising Costs:

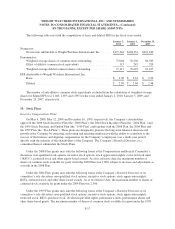

Advertising costs consist primarily of national and local direct mail, television, online media and

spokesperson’s fees. All costs related to advertising are expensed in the period incurred, except for media

production related costs that are expensed the first time the advertising takes place. Total advertising expenses

for the fiscal years ended January 2, 2010, January 3, 2009 and December 29, 2007 were $190,999, $214,218 and

$194,960, respectively.

Income Taxes:

Deferred income tax assets and liabilities result primarily from temporary differences between the financial

statement and tax bases of assets and liabilities, using enacted tax rates in effect for the year in which differences

are expected to reverse. If it is more likely than not that some portion of a deferred tax asset will not be realized,

a valuation allowance is recognized. The Company considers historic levels of income, estimates of future

taxable income and feasible tax planning strategies in assessing the need for a tax valuation allowance.

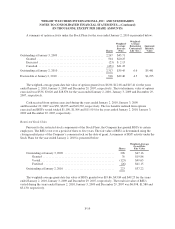

On December 31, 2006, the first day of fiscal 2007, the Company adopted new accounting guidance

governing the recognition and measurement of uncertain tax positions. This new accounting guidance prescribes

a recognition threshold and a measurement attribute for the financial statement recognition and measurement of

tax positions taken or expected to be taken in a tax return. For those benefits to be recognized, a tax position must

be more likely than not to be sustained upon examination by taxing authorities. The amount recognized is

measured as the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate

settlement. As a result of the December 31, 2006 adoption of this accounting guidance, the Company increased

its tax liability for unrecognized tax benefits by $1,907, which was accounted for as a reduction to the opening

balance of retained earnings for fiscal 2007.

In addition, assets and liabilities acquired in purchase business combinations are assigned their fair values

and deferred taxes are provided for lower or higher tax bases.

Derivative Instruments and Hedging:

The Company is exposed to certain risks related to its ongoing business operations, primarily interest rate

risk and foreign currency risk. The primary risk managed by using derivative instruments is interest rate risk.

F-10