WeightWatchers 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.between book and cash taxes and typical non-cash depreciation and amortization expenses. Net cash used for

investing and financing activities combined totaled $270.6 million. Investing activities, consisting primarily of

capital spending, utilized $23.6 million. Net cash used for financing activities totaled $247.0 million, including

dividend payments of $54.1 million and long-term debt payments of $194.5 million.

Fiscal 2008

At the end of fiscal 2008, cash and cash equivalents were $47.3 million, an increase of $7.5 million from the

end of fiscal 2007. Cash flows provided by operating activities were $241.2 million. The cash provided by

operations was driven by our net income of $204.3 million, changes in our working capital, and differences

between book and cash taxes. Fiscal 2008 cash from operations was negatively impacted by timing of payments.

Certain fiscal 2007 and fiscal 2009 tax and other payments amounting to approximately $30.0 million were made

in fiscal 2008. Investing activities utilized $72.2 million, including $39.7 million for our fiscal 2008 franchise

acquisitions and $31.6 million for capital spending. Net cash used for financing activities totaled $160.1 million.

This included the repurchase of 2.8 million shares of our common stock for $116.0 million and dividend

payments of $55.0 million. See Item 5 in Part II of this Annual Report on Form 10-K for more information

regarding our stock repurchase plan.

Fiscal 2007

At the end of fiscal 2007, cash and cash equivalents were $39.8 million, an increase of $2.3 million from the

end of fiscal 2006. Cash flows provided by operating activities were $318.5 million. The cash provided by

operations was driven by our net income of $201.2 million, changes in our working capital and differences

between book and cash taxes. Investing activities utilized $48.8 million, including $16.8 million for our fiscal

2007 franchise acquisitions and $31.8 million for capital spending. Net cash used for financing activities totaled

$269.2 million. This included the repurchase of approximately 19.1 million shares of our common stock for

$1,033.6 million in connection with our Tender Offer and share repurchase from Artal (as further explained in

“Liquidity and Capital Resources—Stock Transactions”) and dividend payments of $58.5 million, financed

primarily by net proceeds from borrowings of $799.0 million.

Long-Term Debt

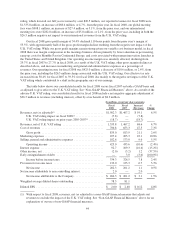

As of the end of fiscal 2009, our credit facility consisted of a term loan facility consisting of two tranche A

facilities, or the Term Loan A and Additional Term Loan A, a tranche B facility, or the Term Loan B, and a

revolving line of credit, or the Revolver, or collectively, the WWI Credit Facility.At the end of fiscal 2009, we

had debt of $1,453.0 million and had additional availability under our $500.0 million Revolver of $368.9 million.

In January 2007, in connection with the Tender Offer (discussed in further detail in “Item 1. Business—

History—Tender Offer and Share Repurchase”), we increased our debt capacity by adding the Additional Term

Loan A in the amount of $700.0 million and the Term Loan B in the amount of $500.0 million. We utilized

$185.8 million of these proceeds to pay off the WW.com Credit Facilities. In connection with this refinancing,

we incurred expenses of $3.0 million. The Additional Term Loan A and the Term Loan B mature in January

2013 and January 2014, respectively.

At the end of fiscal 2009, fiscal 2008 and fiscal 2007, our debt consisted entirely of variable-rate

instruments. The average interest rate on our debt, exclusive of the impact of the SWAPs, was approximately

1.5%, 4.7% and 6.5% per annum at the end of fiscal 2009, fiscal 2008 and fiscal 2007, respectively.

48