WeightWatchers 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off-Balance Sheet Transactions

As part of our ongoing business, we do not participate in transactions that generate relationships with

unconsolidated entities or financial partnerships established for the purpose of facilitating off-balance sheet

arrangements or other contractually narrow or limited purposes, such as entities often referred to as structured

finance or special purpose entities.

Related Parties

For a discussion of related party transactions affecting us, see “Item 13. Certain Relationships and Related

Transactions, and Director Independence” in Part III of this Annual Report on Form 10-K.

Seasonality

Our business is seasonal, with revenues generally decreasing at year end and during the summer months.

Our advertising schedule supports the three key enrollment-generating seasons of the year: winter, spring and

fall, with winter having the highest concentration of advertising spending. The timing of certain holidays,

particularly Easter, which precedes the spring marketing campaign and occurs between March 22 and April 25,

may affect our results of operations and the year-to-year comparability of our results. For example, in fiscal

2009, Easter fell on April 12, which means that the spring marketing campaign began in the second quarter of

fiscal 2009 as opposed to the first quarter of fiscal 2008. The introduction of Monthly Pass in the meetings

business has resulted in less seasonality with regard to our lecture income revenues because its revenues are

amortized over the related subscription period. Our operating income for the first half of the year is generally the

strongest. While WeightWatchers.com experiences similar seasonality in terms of new subscriber signups, its

revenue tends to be less seasonal because it amortizes subscription revenue over the related subscription period.

Recently Issued Accounting Standards

In October 2009, new revenue recognition guidance was issued regarding arrangements with multiple

deliverables. The new guidance permits companies to recognize revenue from certain deliverables earlier than

previously permitted, if certain criteria are met. The new guidance is effective for fiscal years beginning on or

after June 15, 2010 and is not expected to have a material impact on our financial position, results of operations

or cash flows.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risks relating to interest rate changes and foreign currency fluctuations. As of the

end of fiscal 2009, other than as described below, there have been no material changes to the Company’s

exposure to market risk since the end of fiscal 2008.

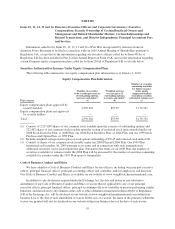

Interest Rate Risk

Our exposure to market risk for changes in interest rates relates to interest expense of variable rate debt. As

of the end of fiscal 2009, we had entered into interest rate swaps with notional amounts totaling $900.0 million to

hedge a substantial portion of our variable rate debt. In addition to these swaps, on January 13, 2009, we entered

into another interest rate swap with an effective date of January 4, 2010 and a termination date of January 27,

2014 at an initial notional amount of $425.0 million. During the term of this additional interest rate swap, the

notional amount will fluctuate with the highest notional amount being $755.0 million. Changes in the fair value

of these derivatives will be recorded each period in earnings for non-qualifying derivatives or accumulated other

comprehensive income (loss) for qualifying derivatives.

Based on the amount of our variable rate debt and interest rate swap agreements as of the end of fiscal 2009,

a hypothetical 50 basis point increase or decrease in interest rates on our variable debt would increase or decrease

our annual interest expense by approximately $2.8 million.

52