WeightWatchers 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

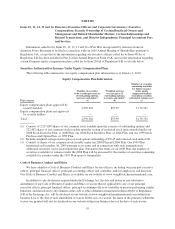

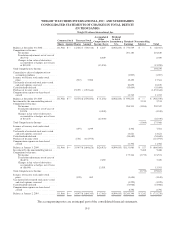

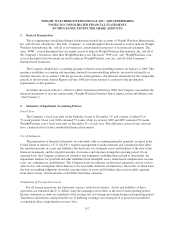

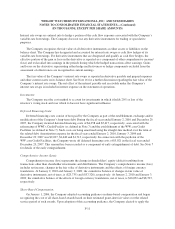

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN TOTAL DEFICIT

(IN THOUSANDS)

Weight Watchers International, Inc.

Accumulated

Other

Comprehensive

Income (Loss)

Dividend

to Artal

Luxembourg

S.A.

Retained

Earnings

Noncontrolling

Interest Total

Common Stock Treasury Stock

Shares Amount Shares Amount

Balance at December 30, 2006............111,988 $— 14,486 $ (540,318) $ 6,247 $(304,835) $ 770,539 $ — $ (68,367)

Comprehensive Income:

Net income ....................... 201,180 201,180

Translation adjustment, net of taxes of

($4,734) ....................... 8,049 8,049

Changes in fair value of derivatives

accounted for as hedges, net of taxes

of $10,199 ..................... (15,950) (15,950)

Total Comprehensive Income ............ 193,279

Cummulative effect of adoption of new

accounting guidance .................. (1,907) (1,907)

Issuance of treasury stock under stock

plans .............................. (967) 3,908 13,453 17,361

Tax benefit of restricted stock units vested

and stock options exercised ............ 10,879 10,879

Cash dividends declared ................. (55,694) (55,694)

Purchase of treasury stock ............... 19,059 (1,033,644) (1,033,644)

Compensation expense on share-based

awards ............................ 11,763 11,763

Balance at December 29, 2007............111,988 $— 32,578 $(1,570,054) $ (1,654) $(304,835) $ 950,213 $ — $ (926,330)

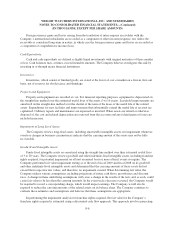

Investment by the noncontrolling interest . . . 2,511 2,511

Comprehensive Income:

Net income ....................... 204,331 (1,984) 202,347

Translation adjustment, net of taxes of

$3,028 ......................... (4,949) (4,949)

Changes in fair value of derivatives

accounted for as hedges, net of taxes

of $14,278 ..................... (22,330) (22,330)

Total Comprehensive Income ............ (1,984) 175,068

Issuance of treasury stock under stock

plans .............................. (297) 1,199 6,302 7,501

Tax benefit of restricted stock units vested

and stock options exercised ............ 13,621 13,621

Cash dividends declared ................. (54,689) (54,689)

Purchase of treasury stock ............... 2,786 (115,973) (115,973)

Compensation expense on share-based

awards ............................ 11,302 11,302

Balance at January 3, 2009...............111,988 $— 35,067 $(1,684,828) $(28,933) $(304,835) $1,131,080 $ 527 $ (886,989)

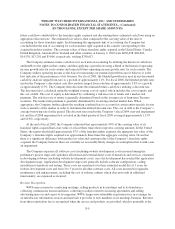

Investment by the noncontrolling interest . . . 5,488 5,488

Comprehensive Income:

Net income ....................... 177,344 (2,773) 174,571

Translation adjustment, net of taxes of

($4,891) ....................... 7,659 7,659

Changes in fair value of derivatives

accounted for as hedges, net of taxes

of ($8,690) ..................... 13,591 13,591

Total Comprehensive Income ............ (2,773) 195,821

Issuance of treasury stock under stock

plans .............................. (120) 485 (1,654) (1,169)

Tax shortfall of restricted stock units vested

and stock options exercised ............ (1,229) (1,229)

Cash dividends declared ................. (53,988) (53,988)

Compensation expense on share-based

awards ............................ 8,796 8,796

Balance at January 2, 2010...............111,988 $— 34,947 $(1,684,343) $ (7,683) $(304,835) $1,260,349 $ 3,242 $ (733,270)

The accompanying notes are an integral part of the consolidated financial statements.

F-5