WeightWatchers 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

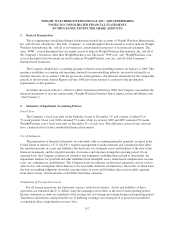

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

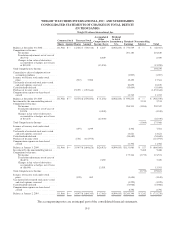

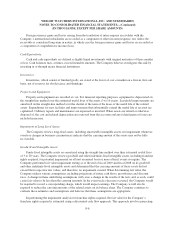

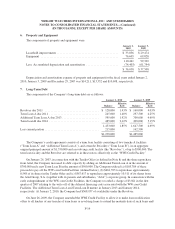

6. Property and Equipment

The components of property and equipment were:

January 2,

2010

January 3,

2009

Leasehold improvements .......................................... $ 33,836 $ 29,474

Equipment ..................................................... 76,605 69,828

110,441 99,302

Less: Accumulated depreciation and amortization ...................... (74,403) (61,794)

$ 36,038 $ 37,508

Depreciation and amortization expense of property and equipment for the fiscal years ended January 2,

2010, January 3, 2009 and December 29, 2007 was $14,211, $13,352 and $10,698, respectively.

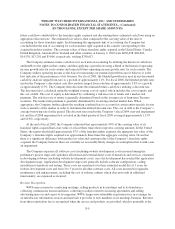

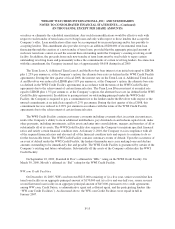

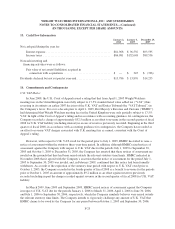

7. Long-Term Debt

The components of the Company’s long-term debt are as follows:

January 2, 2010 January 3, 2009

Balance

Effective

Rate Balance

Effective

Rate

Revolver due 2011 ..................................... $ 128,000 1.43% $ 160,000 4.03%

Term Loan A due 2011 .................................. 245,000 1.40% 297,500 4.25%

Additional Term Loan A due 2013 ......................... 595,000 1.92% 700,000 4.69%

Term Loan B due 2014 .................................. 485,000 2.12% 490,000 5.15%

1,453,000 1.85% 1,647,500 4.69%

Less current portion ..................................... 215,000 162,500

$1,238,000 $1,485,000

The Company’s credit agreement consists of a term loan facility consisting of two tranche A facilities

(“Term Loan A” and “Additional Term Loan A”), and a tranche B facility (“Term Loan B”), in an aggregate

original principal amount of $1,550,000 and a revolving credit facility (the “Revolver”), of up to $500,000. The

term loan facility and the Revolver are referred to in these notes collectively as the “WWI Credit Facility.”

On January 26, 2007, in connection with the Tender Offer (as defined in Note 8) and the share repurchase

from Artal, the Company increased its debt capacity by adding an Additional Term Loan A in the amount of

$700,000 and a new Term Loan B in the amount of $500,000. The Company utilized (a) $185,784 of these

proceeds to pay off the WW.com Credit Facilities (defined below), (b) $461,593 to repurchase approximately

8,548 of its shares in the Tender Offer and (c) $567,617 to repurchase approximately 10,511 of its shares from

the Artal Group, S.A. (together with its parents and subsidiaries, “Artal”) corporate group. In connection with the

early extinguishment of the WW.com Credit Facilities, the Company recorded a charge of $3,021 in the first

quarter of 2007 relating to the write-off of the deferred financing costs associated with the WW.com Credit

Facilities. The Additional Term Loan A and Term Loan B mature in January 2013 and January 2014,

respectively. At January 2, 2010, the Company had $368,937 of availability under the Revolver.

On June 26, 2009, the Company amended the WWI Credit Facility to allow it to make loan modification

offers to all lenders of any tranche of term loans or revolving loans to extend the maturity date of such loans and/

F-14