WeightWatchers 2009 Annual Report Download - page 57

Download and view the complete annual report

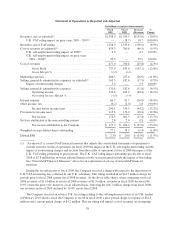

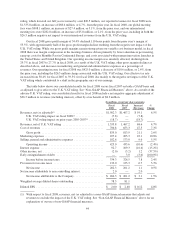

Please find page 57 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.component of this decline in revenues in fiscal 2009 versus the prior year was the unfavorable impact of foreign

currency exchange rates, which reduced our revenues by $63.9 million, or 4.1%. In fiscal 2009, the average

exchange rate from the British pound to the U.S. dollar dropped by 15.3% versus the prior year, from 1.853 to

1.569, and the average exchange rate from the Euro to the U.S. dollar dropped by 5.1% versus the prior year,

from 1.471 to 1.396.

For the 52 weeks of fiscal 2009, global meeting fees were $817.5 million, a decrease of $90.6 million, or

10.0%, from the prior year of 53 weeks. After adjusting fiscal 2008 for the U.K. VAT ruling, global meeting fees

were $926.8 million in fiscal 2008. On this as-adjusted basis, global meeting fees in fiscal 2009 decreased $75.0

million, or 8.1%, as compared to fiscal 2008 on a constant currency basis. Global meeting paid weeks were

87.6 million in fiscal 2009 versus 91.3 million in the prior year, a 4.0% decline. Global attendance declined 9.5%

to 54.3 million in fiscal 2009 versus 60.0 million in the prior year.

Declining volume trends in the midst of difficult economic conditions worldwide led to a decline in global

meeting fees in fiscal 2009, but the increased acceptance of Monthly Pass in our international markets mitigated

part of this revenue decline. We now have Monthly Pass outside the United States, in the United Kingdom,

Germany, and Australia, each of which launched in the third quarter of fiscal 2007, France, which launched

during the second quarter of fiscal 2008 and in Sweden, which launched during the fourth quarter of fiscal 2009.

The global average meeting fee per attendee in fiscal 2009, which decreased 0.5% versus the prior year in total,

actually increased 1.6% on a comparable basis excluding the negative impact of foreign currency and the fiscal

2008 U.K. VAT ruling impact.

In NACO, meeting fees for the 52 weeks of fiscal 2009 were $547.0 million, a decline of $78.3 million, or

12.5%, from $625.3 million for the 53 weeks of fiscal 2008. Meeting attendances of 32.1 million and paid weeks

of 55.8 million declined at a similar rate versus the prior year, down 11.8% and 8.4%, respectively. As a result of

economic conditions, it is generally acknowledged that consumers significantly reduced their discretionary

spending in 2009. We believe this has had the impact of deferring weight loss efforts on the part of some

consumers, particularly potential new members, whose decision to spend on any new service or product was

likely to be highly scrutinized. Partially in an effort to spur demand in this economic environment, in September

2009, NACO launched its first new major price promotion other than the free registration promotion which has

been part of our seasonal marketing campaigns for many years. This new promotion lowered our second half

fiscal 2009 meeting fees by approximately 1.7%, but had an immediate, positive effect on our enrollment trends

and on shifting members from the pay-as-you-go payment model into the more profitable Monthly Pass recurring

payment plan model. Members who purchase Monthly Pass on average have a longer tenure and are thus more

profitable to us.

Our international meeting fees were $270.5 million for the 52 weeks of fiscal 2009 as compared to $282.8

million, a decrease of $12.3 million, or 4.3%, from the prior year of 53 weeks and a decrease of 10.3% after

adjusting fiscal 2008 for the U.K. VAT ruling which reduced 2008 international meeting fees by $18.7 million.

The decline in international meeting fees was the result of the negative impact of foreign currency exchange. On

a constant currency basis, international meeting fees in fiscal 2009 increased $0.9 million, or 0.3%, from the

prior year as adjusted for the U.K. VAT ruling. International meeting fees per attendee, which increased 1.7%

including the negative impact of foreign currency exchange and including the impact in fiscal 2008 of the U.K.

VAT ruling, increased by 6.7% in constant currency on a comparable to prior year basis excluding the impact of

the U.K. VAT ruling. Monthly Pass in the United Kingdom, Germany and France enabled constant currency

meeting fee revenue stability in fiscal 2009 versus the prior year, and drove a 4.9% increase over prior year in

total paid weeks in our international meetings business, despite the overall international attendance decline of

5.9% in the period. Fiscal 2009 paid weeks increased 8.1% in the United Kingdom and 1.6% in Continental

Europe versus the prior year.

Global product sales for fiscal 2009 were $292.1 million, a decline of $47.7 million, or 14.0%, from $339.8

million in fiscal 2008, with 5.9% of decline resulting from foreign currency translation. Global in-meeting

product sales per attendee declined 2.8% in fiscal 2009 versus the prior year; however, on a constant currency

41