WeightWatchers 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

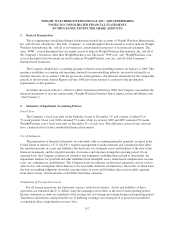

4. Joint Venture

On February 5, 2008, Weight Watchers Asia Holdings Ltd. (“Weight Watchers Asia”), a direct wholly-

owned subsidiary of the Company, and Danone Dairy Asia, an indirect wholly-owned subsidiary of Groupe

DANONE S.A., entered into a joint venture agreement to establish a weight management business in the

People’s Republic of China. Pursuant to the terms of the joint venture agreement, Weight Watchers Asia and

Danone Dairy Asia own 51% and 49%, respectively, of the Joint Venture.

Because the Company has a direct controlling financial interest in the Joint Venture, it began to consolidate

this entity in the first quarter of fiscal 2008.

5. Goodwill and Other Intangible Assets

The Company performed its annual impairment review of goodwill and other indefinite-lived intangible

assets as of January 2, 2010 and January 3, 2009 and determined that no impairment existed. Goodwill is due

mainly to the acquisition of the Company by H.J. Heinz Company (“Heinz”) in 1978 and the acquisition of

WW.com in 2005. For the year ended January 2, 2010, the change in goodwill is due to foreign currency

fluctuations. Franchise rights acquired are due to acquisitions of the Company’s franchised territories. For the

year ended January 2, 2010, franchise rights acquired increased due to foreign currency fluctuations.

The Company’s goodwill by reportable segment at the end of fiscal 2009 and fiscal 2008 was $25,173 and

$25,096, respectively, related to the Weight Watchers International segment and $26,200 related to the

WeightWatchers.com segment for both years, totaling $51,373 and $51,296, respectively.

Aggregate amortization expense for finite-lived intangible assets was recorded in the amounts of $13,664,

$11,167 and $8,335 for the fiscal years ended January 2, 2010, January 3, 2009 and December 29, 2007,

respectively.

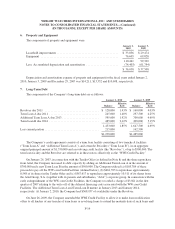

The carrying amount of finite-lived intangible assets as of January 2, 2010 and January 3, 2009 was as

follows:

January 2, 2010 January 3, 2009

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Capitalized software costs .............................. $44,486 $25,396 $39,027 $17,408

Trademarks .......................................... 9,602 8,593 9,287 8,233

Website development costs ............................. 29,878 19,266 25,847 15,995

Other ............................................... 5,741 4,819 5,741 4,735

$89,707 $58,074 $79,902 $46,371

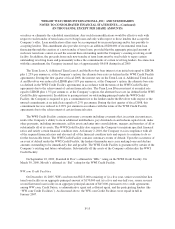

Estimated amortization expense of existing finite lived intangible assets for the next five fiscal years is as

follows:

2010 ............................................................. $13,837

2011 ............................................................. $10,563

2012 ............................................................. $ 4,841

2013 ............................................................. $ 2,053

2014 ............................................................. $ 198

F-13