WeightWatchers 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign Currency Risk

Other than inter-company transactions between our domestic and foreign entities, we generally do not have

significant transactions that are denominated in a currency other than the functional currency applicable to each

entity. As a result, substantially all of our revenues and expenses, other than those of WeightWatchers.com, in

each jurisdiction in which we operate are in the same functional currency. In general, we are a net receiver of

currencies other than the U.S. dollar. Accordingly, changes in exchange rates may negatively affect our revenues

and gross margins as expressed in U.S. dollars. From time to time, we may enter into forward and swap contracts

to hedge transactions denominated in foreign currencies to reduce the currency risk associated with fluctuating

exchange rates. Realized and unrealized gains and losses from any of these transactions may be included in net

income for the period.

Fluctuations in currency exchange rates, particularly with respect to the euro and pound sterling, may

impact our shareholders’ equity. The assets and liabilities of our non-U.S. subsidiaries are translated into U.S.

dollars at the exchange rates in effect at the balance sheet date. Revenues and expenses are translated into U.S.

dollars at the weighted average exchange rate for the period. The resulting translation adjustments are recorded in

shareholders’ equity as a component of accumulated other comprehensive income (loss). In addition, exchange

rate fluctuations will cause the U.S. dollar translated amounts to change in comparison to prior periods.

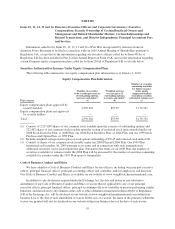

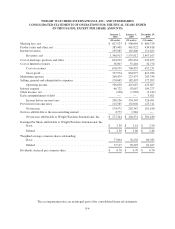

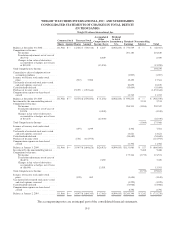

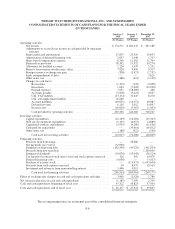

Item 8. Financial Statements and Supplementary Data

This information is incorporated by reference to our consolidated financial statements on pages F-1 through

F-30 and our financial statement schedule on page S-1, including the report thereon of PricewaterhouseCoopers

LLP on page F-2.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be

disclosed in our reports under the Exchange Act is recorded, processed, summarized and reported within the time

periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is

accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial

Officer, as appropriate, to allow timely decisions regarding required disclosures. Any controls and procedures, no

matter how well designed and operated, can provide only reasonable assurance of achieving the desired control

objectives. Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

has evaluated the effectiveness of the design and operation of our disclosure controls and procedures as of the

end of the period covered by this report. Based upon that evaluation and subject to the foregoing, our Chief

Executive Officer and Chief Financial Officer concluded that the design and operation of our disclosure controls

are effective at the reasonable assurance level.

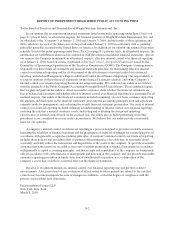

Internal Control over Financial Reporting

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial

reporting. Internal control over financial reporting is a process designed under the supervision and with the

participation of our management, including our principal executive officer and principal financial officer, to

provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with accounting principles generally accepted in the United States

of America.

53