US Cellular 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 15 STOCK-BASED COMPENSATION (Continued)

The total fair value of deferred compensation stock units that vested during 2010, 2009 and 2008 was

$0.4 million, $0.1 million and $0.1 million, respectively. The weighted average grant date fair value of

deferred compensation stock units granted in 2010, 2009 and 2008 was $40.76, $33.58 and $56.23,

respectively.

Employee Stock Purchase Plan—The U.S. Cellular 2009 Employee Stock Purchase Plan became effective

January 1, 2009 and will terminate December 31, 2013. Under this plan, eligible employees of

U.S. Cellular and its subsidiaries may purchase a limited number of U.S. Cellular Common Shares on a

quarterly basis. During 2008, the 2003 Employee Stock Purchase Plan was effective but terminated

December 31, 2008. U.S. Cellular employees are also eligible to participate in the TDS Employee Stock

Purchase Plan.

Under these plans, the per share cost to participants is 85% of the market value of the U.S. Cellular

Common Shares or TDS Special Common Shares as of the issuance date. The employee stock

purchase plans are considered compensatory plans; therefore, recognition of compensation cost for

stock issued under these plans is required. Compensation cost is measured as the difference between

the cost of the shares to plan participants and the market value of the shares on the date of issuance.

Compensation of Non-Employee Directors—U.S. Cellular issued 9,000 and 5,200 Common Shares in

2010 and 2009, respectively, under its Non-Employee Director Compensation Plan. No Common Shares

were issued under this plan in 2008.

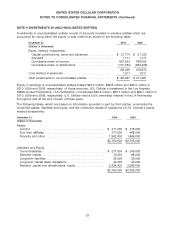

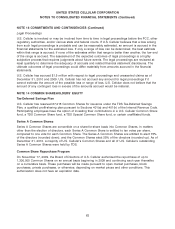

Stock-Based Compensation Expense

The following table summarizes stock-based compensation expense recognized during 2010, 2009 and

2008:

Year Ended December 31, 2010 2009 2008

(Dollars in thousands)

Stock option awards ....................................... $ 7,179 $ 7,024 $ 7,331

Restricted stock unit awards ................................. 10,056 8,640 7,213

Deferred compensation matching stock unit awards ................ 165 151 350

Awards under employee stock purchase plan ..................... 314 241 228

Awards under non-employee director compensation plan ............ 330 306 —

Total stock-based compensation, before income taxes ............... 18,044 16,362 15,122

Income tax benefit ........................................ (6,812) (6,154) (5,585)

Total stock-based compensation expense, net of income taxes ........ $11,232 $10,208 $ 9,537

In 2010, 2009 and 2008, stock-based compensation expense of $2.0 million, $1.9 million and

$1.5 million, respectively, was recorded in System operations expense and $16.0 million, $14.5 million

and $13.6 million, respectively, was recorded in Selling, general and administrative expense in the

Consolidated Statement of Operations.

At December 31, 2010, unrecognized compensation cost for all U.S. Cellular stock-based compensation

awards was $20.4 million and is expected to be recognized over a weighted average period of 1.8 years.

U.S. Cellular’s tax benefits realized from the exercise of stock options and other awards totaled

$2.8 million in 2010.

67