US Cellular 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

U.S. Cellular prepares its consolidated financial statements in accordance with accounting principles

generally accepted in the United States of America (‘‘GAAP’’). U.S. Cellular’s significant accounting

policies are discussed in detail in Note 1—Summary of Significant Accounting Policies and Recent

Accounting Pronouncements in the Notes to Consolidated Financial Statements.

Management believes the application of the following critical accounting policies and the estimates

required by such application reflect its most significant judgments and estimates used in the preparation

of U.S. Cellular’s consolidated financial statements. Management has discussed the development and

selection of each of the following accounting policies and related estimates and disclosures with the

Audit Committee of U.S. Cellular’s Board of Directors.

Goodwill and Licenses

See the Goodwill and Licenses Impairment Assessment section of Note 1—Summary of Significant

Accounting Policies and Recent Accounting Pronouncements in the Notes to Consolidated Financial

Statements for information on goodwill and licenses impairment testing policies and methods.

See Note 8—Licenses and Goodwill in the Notes to Consolidated Financial Statements for additional

information related to goodwill and licenses activity in 2010 and 2009.

The following discussion compares the impairment test as of November 1, 2010 to that as of

November 1, 2009.

Goodwill

U.S. Cellular tests goodwill for impairment at the level of reporting referred to as a ‘‘reporting unit.’’ For

purposes of impairment testing of goodwill in 2010, U.S. Cellular identified five reporting units based on

geographic service areas. There were no changes to U.S. Cellular’s reporting units, the allocation of

goodwill to those reporting units, or to U.S. Cellular’s overall goodwill impairment testing methodology

between its two most recent impairment testing dates, November 1, 2010 and November 1, 2009.

A discounted cash flow approach was used to value each reporting unit, using value drivers and risks

specific to the current industry and economic markets. The cash flow estimates incorporated

assumptions that market participants would use in their estimates of fair value and may not be indicative

of U.S. Cellular specific assumptions. Key assumptions made in this process were the revenue growth

rate, discount rate, and projected capital expenditures. These assumptions were as follows as of the two

most recent impairment testing dates:

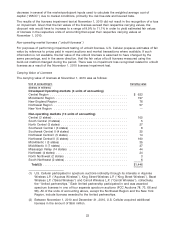

Key assumptions November 1, 2010 November 1, 2009

Weighted-average expected revenue growth rate

(next four years) ........................ 2.18% 2.13%

Weighted-average long-term and terminal revenue

growth rate (after year four) ................ 2.00% 2.00%

Discount rate ............................ 10.5% 11.5%

Average annual capital expenditures (millions) .... $540 $520

The decrease in the discount rate between November 1, 2009 and 2010 was a result of the decrease in

several of the market-participant inputs used to calculate the weighted average cost of capital (‘‘WACC’’)

due to improved market conditions, primarily the risk-free rate and levered beta, partially offset by a

higher company-specific risk premium.

20