US Cellular 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

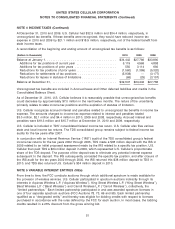

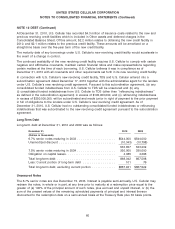

NOTE 12 DEBT (Continued)

The 7.5% senior notes are due June 15, 2034. Interest on the notes is payable quarterly. U.S. Cellular

may redeem the notes, in whole or in part, at any time on or after June 17, 2009, at a redemption price

equal to 100% of the principal amount redeemed plus accrued and unpaid interest.

General

The covenants of the long-term debt obligations place certain restrictions on U.S. Cellular, including

restrictions on the ability of its subsidiaries, subject to certain exclusions, to incur additional liens, enter

into sale and leaseback transactions, and sell, consolidate or merge assets.

U.S. Cellular’s long-term debt indenture does not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a

downgrade in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt

financing in the future.

U.S. Cellular does not have any annual requirements for principal payments on long-term debt over the

next five years (excluding capital lease obligations).

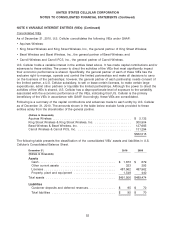

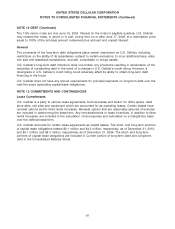

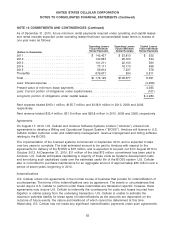

NOTE 13 COMMITMENTS AND CONTINGENCIES

Lease Commitments

U.S. Cellular is a party to various lease agreements, both as lessee and lessor, for office space, retail

store sites, cell sites and equipment which are accounted for as operating leases. Certain leases have

renewal options and/or fixed rental increases. Renewal options that are reasonably assured of exercise

are included in determining the lease term. Any rent abatements or lease incentives, in addition to fixed

rental increases, are included in the calculation of rent expense and calculated on a straight-line basis

over the defined lease term.

U.S. Cellular accounts for certain lease agreements as capital leases. The short- and long-term portions

of capital lease obligations totaled $0.1 million and $4.3 million, respectively, as of December 31, 2010,

and $0.1 million and $4.3 million, respectively, as of December 31, 2009. The short- and long-term

portions of capital lease obligations are included in Current portion of long-term debt and Long-term

debt in the Consolidated Balance Sheet.

61