US Cellular 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Allowance for Doubtful Accounts

U.S. Cellular’s accounts receivable primarily consist of amounts owed by customers pursuant to service

contracts and for equipment sales, by agents for sales of equipment to them and by other wireless

carriers whose customers have used U.S. Cellular’s wireless systems.

The allowance for doubtful accounts is the best estimate of the amount of probable credit losses related

to existing accounts receivable. The allowance is estimated based on historical experience and other

factors that could affect collectability. Accounts receivable balances are reviewed on either an aggregate

or individual basis for collectability depending on the type of receivable. When it is probable that an

account balance will not be collected, the account balance is charged against the allowance for doubtful

accounts. U.S. Cellular does not have any off-balance sheet credit exposure related to its customers.

U.S. Cellular will continue to monitor its accounts receivable balances and related allowance for doubtful

accounts on an ongoing basis to assess whether it has adequately provided for potentially uncollectible

amounts.

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the

Notes to Consolidated Financial Statements for additional information regarding U.S. Cellular’s allowance

for doubtful accounts.

Loyalty Reward Program

See the Revenue Recognition section of Note 1—Summary of Significant Accounting Policies and Recent

Accounting Pronouncements to the Notes to Consolidated Financial Statements for a description of this

program and the related accounting.

U.S. Cellular follows the deferred revenue method of accounting for its loyalty reward program. Under

this method, revenue allocated to loyalty reward points is deferred and recognized at the time the

customer redeems loyalty reward points. U.S. Cellular does not have sufficient historical data in which to

estimate any portion of loyalty reward points that will not be redeemed. As such, 100% of the value of

the loyalty reward points is deferred until redeemed. U.S. Cellular will periodically review and revise the

redemption rate as appropriate based on history and related future expectations.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

U.S. Cellular is billed for all services it receives from TDS pursuant to the terms of various agreements

between U.S. Cellular and TDS. These billings are included in U.S. Cellular’s Selling, general and

administrative expenses. Some of these agreements were established prior to U.S. Cellular’s initial public

offering, when TDS owned more than 90% of U.S. Cellular’s outstanding capital stock, and may not

reflect terms that would be obtainable from an unrelated third party through arms-length negotiations.

Billings from TDS to U.S. Cellular are based on expenses specifically identified to U.S. Cellular and on

allocations of common expenses. Such allocations are based on the relationship of U.S. Cellular’s

assets, employees, investment in property, plant and equipment and expenses to the total assets,

employees, investment in property, plant and equipment and expenses of TDS. Management believes

that the method TDS uses to allocate common expenses is reasonable and that all expenses and costs

applicable to U.S. Cellular are reflected in U.S. Cellular’s consolidated financial statements. Billings from

TDS to U.S. Cellular totaled $107.5 million, $114.8 million and $113.3 million for 2010, 2009 and 2008,

respectively.

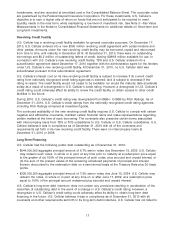

The following persons are partners of Sidley Austin LLP, the principal law firm of U.S. Cellular and its

subsidiaries: Walter C.D. Carlson, a director of U.S. Cellular, a director and non-executive Chairman of

the Board of Directors of TDS and a trustee and beneficiary of a voting trust that controls TDS; William S.

DeCarlo, the General Counsel of TDS and an Assistant Secretary of TDS and certain subsidiaries of TDS;

and Stephen P. Fitzell, the General Counsel of U.S. Cellular and TDS Telecommunications Corporation

and an Assistant Secretary of U.S. Cellular and certain other subsidiaries of TDS. Walter C.D. Carlson

does not provide legal services to TDS, U.S. Cellular or their subsidiaries. U.S. Cellular and its

subsidiaries incurred legal costs from Sidley Austin LLP of $9.8 million in 2010, $8.6 million in 2009 and

$6.9 million in 2008.

The Audit Committee of the Board of Directors is responsible for the review and evaluation of all related

party transactions, as such term is defined by the rules of the New York Stock Exchange.

24