US Cellular 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

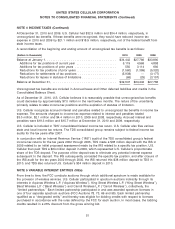

NOTE 3 FAIR VALUE MEASUREMENTS (Continued)

excluding capital lease obligations and the current portion of such long-term debt, was estimated using

market prices for the 7.5% senior notes and discounted cash flow analysis for the 6.7% senior notes.

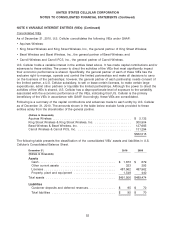

As of December 31, 2009, U.S. Cellular had certain Licenses recorded at fair value in its Consolidated

Balance Sheet as a result of impairment losses recognized at or proximate to December 31, 2009. For

Licenses recorded at fair value, the following table provides information regarding their classification in

the fair value hierarchy:

Fair Value Measurements Using

Quoted Prices in Significant

Active Markets for Other Significant

December 31, Identical Assets Observable Unobservable Total

Description 2009 (Level 1) Inputs (Level 2) Inputs (Level 3) (Losses)(1)

(Dollars in thousands)

Licenses recorded at fair

value ............... $57,000 $— $— $57,000 $(14,000)

(1) These losses represent the excess carrying value of the Licenses over their estimated fair values at

November 1, 2009, the impairment testing date in the fourth quarter of 2009. Such amount is

recorded as Loss on impairment of intangible assets in the Consolidated Statement of Operations.

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements for

information regarding the methods and assumptions used to estimate the fair values for Licenses and a

description of the levels in the fair value hierarchy.

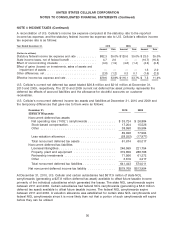

NOTE 4 INCOME TAXES

U.S. Cellular’s Prepaid income taxes were $41.4 million and $0.7 million at December 31, 2010 and 2009,

respectively. At December 31, 2010, Prepaid income taxes included prepaid federal income taxes of

$39.7 million and prepaid state income taxes of $1.7 million. At December 31, 2009, Prepaid income

taxes included prepaid state income taxes of $0.7 million, and Accrued taxes included $2.0 million of

accrued federal income taxes. The timing of the enactment of federal bonus depreciation provisions in

2010 caused a significant increase in prepaid federal income taxes at December 31, 2010.

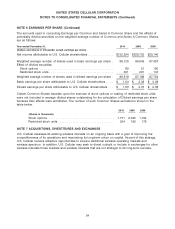

Income tax expense is summarized as follows:

Year Ended December 31, 2010 2009 2008

(Dollars in thousands)

Current

Federal ................................ $19,290 $ 69,942 $ 76,305

State .................................. (11,059) 648 10,089

Deferred

Federal ................................ 55,740 40,368 (50,808)

State .................................. 15,638 5,128 (28,126)

$ 79,609 $116,086 $ 7,460

49