US Cellular 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

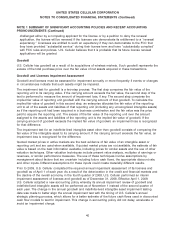

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

portion of the awards as if the awards were, in-substance, multiple awards (graded vesting attribution

method).

Defined Contribution Plans

U.S. Cellular participates in a qualified noncontributory defined contribution pension plan sponsored by

TDS; such plan provides pension benefits for the employees of U.S. Cellular and its subsidiaries. Under

this plan, pension benefits and costs are calculated separately for each participant and are funded

currently. Pension costs were $11.6 million, $12.8 million and $10.3 million in 2010, 2009 and 2008,

respectively.

U.S. Cellular also participates in a defined contribution retirement savings plan (‘‘401(k) plan’’),

sponsored by TDS. Total costs incurred from U.S. Cellular’s contributions to the 401(k) plan were

$15.3 million, $14.3 million and $13.9 million in 2010, 2009 and 2008, respectively.

Operating Leases

U.S. Cellular is a party to various lease agreements for office space, retail sites, cell sites and equipment

that are accounted for as operating leases. Certain leases have renewal options and/or fixed rental

increases. Renewal options that are reasonably assured of exercise are included in determining the lease

term. U.S. Cellular accounts for certain operating leases that contain rent abatements, lease incentives

and/or fixed rental increases by recognizing lease revenue and expense on a straight-line basis over the

lease term.

Recent Accounting Pronouncements

In October 2009, the FASB issued Accounting Standards Update No. 2009-14, Certain Revenue

Arrangements that include Software Elements (‘‘ASU 2009-14’’). ASU 2009-14 amends accounting and

reporting guidance for revenue arrangements involving both tangible products and software that is ‘‘more

than incidental to the tangible product as a whole.’’ ASU 2009-14 is effective for U.S. Cellular on

January 1, 2011. U.S. Cellular does not anticipate that this pronouncement will have a significant impact

on its financial position or results of operations.

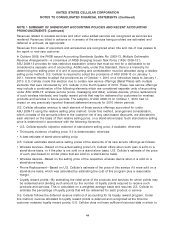

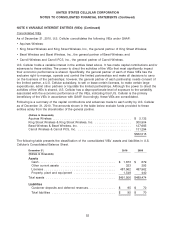

NOTE 2 NONCONTROLLING INTERESTS

Under GAAP, certain noncontrolling interests in consolidated entities with finite lives may meet the

definition of mandatorily redeemable financial instruments. U.S. Cellular’s consolidated financial

statements include certain noncontrolling interests that meet this definition of mandatorily redeemable

financial instruments. These mandatorily redeemable noncontrolling interests represent interests held by

third parties in consolidated partnerships and limited liability companies (‘‘LLCs’’), where the terms of the

underlying partnership or LLC agreement provide for a defined termination date at which time the assets

of the subsidiary are to be sold, the liabilities are to be extinguished and the remaining net proceeds are

to be distributed to the noncontrolling interest holders and U.S. Cellular in accordance with the

respective partnership and LLC agreements. The termination dates of these mandatorily redeemable

noncontrolling interests range from 2085 to 2107.

47