US Cellular 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

– Continued enhancements to U.S. Cellular’s wireless networks;

– Uncertainty related to the National Broadband Plan and other rulemaking by the Federal

Communications Commission (‘‘FCC’’), including uncertainty relating to future eligible

telecommunication carrier (‘‘ETC’’) funding from the universal service fund (‘‘USF’’); and

– Exclusive arrangements between manufacturers of wireless devices and other carriers that restrict

U.S. Cellular’s access to devices desired by customers.

Cash Flows and Investments

U.S. Cellular believes that cash and investments on hand, expected future cash flows from operating

activities and sources of external financing provide substantial liquidity and financial flexibility and are

sufficient to permit U.S. Cellular to finance its contractual obligations and anticipated capital expenditures

for the foreseeable future. U.S. Cellular continues to seek to maintain a strong balance sheet and an

investment grade credit rating.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ below for additional information

related to cash flows and investments, including information related to U.S. Cellular’s new revolving

credit agreement.

2011 Estimates

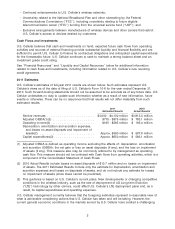

U.S. Cellular’s estimates of full-year 2011 results are shown below. Such estimates represent U.S.

Cellular’s views as of the date of filing of U.S. Cellular’s Form 10-K for the year ended December 31,

2010. Such forward-looking statements should not be assumed to be accurate as of any future date. U.S.

Cellular undertakes no duty to update such information whether as a result of new information, future

events or otherwise. There can be no assurance that final results will not differ materially from such

estimated results.

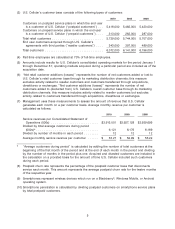

2011 2010

Estimated Results Actual Results

Service revenues .......................... $4,000 - $4,100 million $3,913.0 million

Adjusted OIBDA(1)(3) ....................... $775 - $875 million $ 783.1 million

Operating income(3) ........................ $185 - $285 million $ 195.4 million

Depreciation, amortization and accretion expenses,

and losses on asset disposals and impairment of

assets(2) .............................. Approx. $590 million $ 587.8 million

Capital expenditures(3) ...................... Approx. $650 million $ 583.1 million

(1) Adjusted OIBDA is defined as operating income excluding the effects of: depreciation, amortization

and accretion (OIBDA); the net gain or loss on asset disposals (if any); and the loss on impairment

of assets (if any). This measure also may be commonly referred to by management as operating

cash flow. This measure should not be confused with Cash flows from operating activities, which is a

component of the Consolidated Statement of Cash Flows.

(2) 2010 Actual Results include losses on asset disposals of $10.7 million and no losses on impairment

of assets. The 2011 Estimated Results include only the estimate for Depreciation, amortization and

accretion expenses and losses on disposals of assets, and do not include any estimate for losses

on impairment of assets (since these cannot be predicted).

(3) This guidance is based on U.S. Cellular’s current plans. New developments or changing competitive

conditions in the wireless industry, such as the rate of deployment of 4G Long-term Evolution

(‘‘LTE’’) technology by other carriers, could affect U.S. Cellular’s LTE deployment plans and, as a

result, its capital expenditures and operating expenses.

U.S. Cellular management currently believes that the foregoing estimates represent a reasonable view of

what is achievable considering actions that U.S. Cellular has taken and will be taking. However, the

current general economic conditions in the markets served by U.S. Cellular have created a challenging

3