US Cellular 2010 Annual Report Download - page 31

Download and view the complete annual report

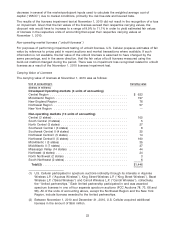

Please find page 31 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.All eighteen units of accounting had a fair value that exceeded the carrying value by at least 10% of the

carrying value. However, any declines in the fair value of such licenses in future periods could result in

the recognition of impairment losses on such licenses and any such impairment losses would have a

negative impact on future results of operations. The impairment losses on licenses are not expected to

have a future impact on liquidity. U.S. Cellular is unable to predict the amount, if any, of future

impairment losses attributable to licenses. Further, historical operating results, particularly amounts

related to impairment losses, are not indicative of future operating results.

Property, Plant and Equipment—Depreciation

U.S. Cellular provides for depreciation using the straight-line method over the estimated useful lives of

the assets. U.S. Cellular depreciates its leasehold improvement assets associated with leased properties

over periods ranging from one to thirty years, which approximates the shorter of the assets’ economic

lives or the specific lease terms.

Annually, U.S. Cellular reviews its property, plant and equipment lives to ensure that the estimated useful

lives are appropriate. The estimated useful lives of property, plant and equipment are a critical

accounting estimate because changing the lives of assets can result in larger or smaller charges for

depreciation expense. Factors used in determining useful lives include technology changes, regulatory

requirements, obsolescence and type of use. U.S. Cellular did not materially change the useful lives of its

property, plant and equipment in 2010, 2009 or 2008.

Income Taxes

U.S. Cellular is included in a consolidated federal income tax return with other members of the TDS

consolidated group. TDS and U.S. Cellular are parties to a Tax Allocation Agreement which provides that

U.S. Cellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal

income tax return and in state income or franchise tax returns in certain situations. For financial

statement purposes, U.S. Cellular and its subsidiaries calculate their income, income tax and credits as if

they comprised a separate affiliated group. Under the Tax Allocation Agreement, U.S. Cellular remits its

applicable income tax payments to TDS.

The amounts of income tax assets and liabilities, the related income tax provision and the amount of

unrecognized tax benefits are critical accounting estimates because such amounts are significant to U.S.

Cellular’s financial condition and results of operations.

The preparation of the consolidated financial statements requires U.S. Cellular to calculate its provision

for income taxes. This process involves estimating the actual current income tax liability together with

assessing temporary differences resulting from the different treatment of items for tax purposes. These

temporary differences result in deferred income tax assets and liabilities, which are included in U.S.

Cellular’s Consolidated Balance Sheet. U.S. Cellular must then assess the likelihood that deferred

income tax assets will be realized based on future taxable income and, to the extent management

believes that realization is not likely, establish a valuation allowance. Management’s judgment is required

in determining the provision for income taxes, deferred income tax assets and liabilities and any

valuation allowance that is established for deferred income tax assets.

U.S. Cellular recognizes the tax benefit from an uncertain tax position only if it is more likely than not that

the tax position will be sustained on examination by the taxing authorities, based on the technical merits

of the position. The tax benefits recognized in the financial statements from such a position are

measured based on the largest benefit that has a greater than 50% likelihood of being realized upon

ultimate resolution.

See Note 4—Income Taxes in the Notes to Consolidated Financial Statements for details regarding U.S.

Cellular’s income tax provision, deferred income taxes and liabilities, valuation allowances and

unrecognized tax benefits, including information regarding estimates that impact income taxes.

23