US Cellular 2010 Annual Report Download - page 45

Download and view the complete annual report

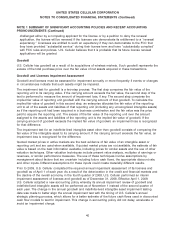

Please find page 45 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS

United States Cellular Corporation (‘‘U.S. Cellular’’), a Delaware Corporation, is an 83%-owned subsidiary

of Telephone and Data Systems, Inc. (‘‘TDS’’).

Nature of Operations

U.S. Cellular owns, operates and invests in wireless systems throughout the United States. As of

December 31, 2010, U.S. Cellular served 6.1 million customers in 26 states. U.S. Cellular operates as

one reportable segment.

Principles of Consolidation

The accounting policies of U.S. Cellular conform to accounting principles generally accepted in the

United States of America (‘‘GAAP’’) as set forth in the Financial Accounting Standards Board (‘‘FASB’’)

Accounting Standards Codification (‘‘ASC’’). Unless otherwise specified, references to accounting

provisions and GAAP in these notes refer to the requirements of the FASB ASC. The consolidated

financial statements include the accounts of U.S. Cellular, its majority-owned subsidiaries, general

partnerships in which U.S. Cellular has a majority partnership interest and variable interest entities

(‘‘VIEs’’) in which U.S. Cellular is the primary beneficiary. Both VIE and primary beneficiary represent

terms defined by GAAP. Prior to January 1, 2010, the primary beneficiary of a VIE was the entity that

recognized a majority of a VIE’s expected gains or losses, as determined based on a quantitative model.

Effective January 1, 2010, new provisions under GAAP related to accounting for VIEs provide for a more

qualitative assessment in determining the primary beneficiary of a VIE. The revised consolidation

guidance related to VIEs effective January 1, 2010 did not change U.S. Cellular’s consolidated reporting

entities.

Effective January 1, 2009, U.S. Cellular adopted new required provisions under GAAP related to the

accounting and reporting for noncontrolling interests.

Pursuant to this adoption, the following provisions were applied prospectively effective January 1, 2009:

• All earnings and losses of a subsidiary are attributed to the parent and the noncontrolling interest,

even if the losses attributable to the noncontrolling interest result in a deficit noncontrolling interest

balance. Previously, any losses exceeding the noncontrolling interest’s investment in the subsidiary

were attributed to the parent. This change did not have a significant impact on U.S. Cellular’s financial

statements in 2010 or 2009.

• Once control of a subsidiary is obtained, changes in ownership interests in that subsidiary that do not

result in a loss of control are accounted for as equity transactions. Previously, decreases in ownership

interest in a subsidiary were accounted for as equity transactions, while increases in ownership

interests of a subsidiary were accounted for as step acquisitions. This change did not have a

significant impact on U.S. Cellular’s financial statements in 2010 or 2009.

All material intercompany accounts and transactions have been eliminated.

Reclassifications

Certain prior year amounts have been reclassified to conform to the 2010 financial statement

presentation. These reclassifications did not affect consolidated net income attributable to U.S. Cellular

shareholders, cash flows, assets, liabilities or equity for the years presented.

Business Combinations

Effective January 1, 2009, U.S. Cellular adopted new required provisions under GAAP related to

accounting for business combinations. Although the revised provisions still require that all business

37