US Cellular 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

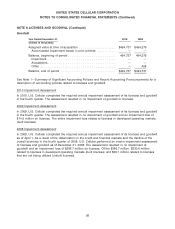

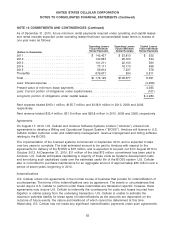

NOTE 7 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

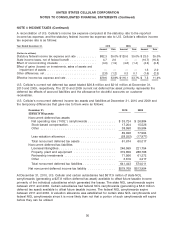

U.S. Cellular acquisitions in 2010, 2009 and 2008 and the allocation of the purchase price for these

acquisitions were as follows:

Allocation of Purchase Price

Net tangible

Purchase Customer assets

(Dollars in thousands) price(1) Goodwill(2) Licenses lists (liabilities)

2010

Licenses .......................... $ 17,101 $ — $ 17,101 $ — $ —

Total ........................... $ 17,101 $ — $ 17,101 $ — $ —

2009

Licenses .......................... $ 15,750 $ — $ 15,750 $ — $ —

Total ........................... $ 15,750 $ — $ 15,750 $ — $ —

2008

FCC Auction 73 licenses(3) ............ $300,479 $ — $300,479 $ — $ —

Other licenses ..................... 32,340 — 32,340 — —

Businesses ........................ 9,152 2,963 4,803 1,045 341

Total ........................... $341,971 $2,963 $337,622 $1,045 $341

(1) Cash amounts paid for the acquisitions may differ from the purchase price due to cash acquired in

the transactions and the timing of cash payments related to the respective transactions.

(2) $1.6 million of the goodwill was amortizable for income tax purposes in 2008.

(3) King Street Wireless L.P., an entity in which a subsidiary of U.S. Cellular is a limited partner, made

these payments. U.S. Cellular loaned these funds to the partnership and the general partner and

made direct capital investments to fund the auction payment.

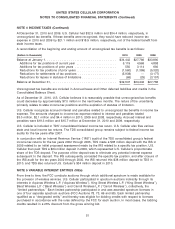

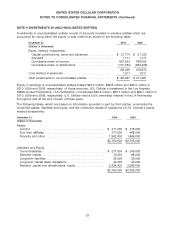

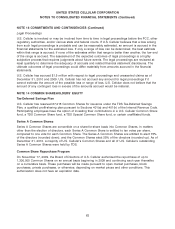

NOTE 8 LICENSES AND GOODWILL

Changes in U.S. Cellular’s licenses and goodwill are presented below. See Note 7—Acquisitions,

Divestitures and Exchanges for information regarding transactions which affected licenses and goodwill

during the periods.

Licenses

Year Ended December 31, 2010 2009

(Dollars in thousands)

Balance, beginning of year ......................... $1,435,000 $1,433,415

Acquisitions .................................. 17,101 15,750

Impairment .................................. — (14,000)

Other ....................................... — (165)

Balance, end of year ............................. $1,452,101 $1,435,000

55