US Cellular 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. Cellular’s financial condition and results of operations because it highlights certain key cash and

non-cash items and their impacts on cash flows from operating activities:

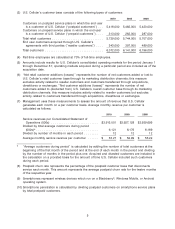

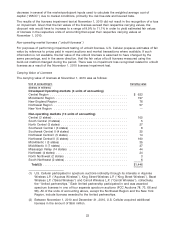

2010 2009 2008

(Dollars in thousands)

Operating income .............................. $195,374 $320,946 $ 28,610

Non-cash items

Depreciation, amortization and accretion ............ 577,054 569,514 576,821

Loss on impairment of intangible assets ............. — 14,000 386,653

Loss on asset disposals, net ..................... 10,717 16,169 17,413

Adjusted OIBDA(1) .............................. $783,145 $920,629 $1,009,497

(1) Adjusted OIBDA is defined as operating income excluding the effects of: depreciation,

amortization and accretion (OIBDA); the net gain or loss on asset disposals (if any); and the

loss on impairment of assets (if any). This measure also may be commonly referred to by

management as operating cash flow. This measure should not be confused with Cash flows

from operating activities, which is a component of the Consolidated Statement of Cash Flows.

Adjusted OIBDA excludes the net gain or loss on asset disposals and loss on impairment of

assets (if any), in order to show operating results on a more comparable basis from period to

period. U.S. Cellular does not intend to imply that any of such amounts that are excluded are

non-recurring, infrequent or unusual and, accordingly, they may be incurred in the future.

Cash flows from operating activities in 2010 were $874.3 million, a decrease of $7.5 million from 2009.

Significant changes included the following:

• Adjusted OIBDA, as shown in the table above, decreased by $137.5 million primarily due to a

decrease in operating income. See discussion in the ‘‘Results of Operations’’ for factors that affected

operating income.

• Changes in inventory provided $40.3 million in 2010 and required $36.0 million in 2009, resulting in a

$76.3 million year-over-year increase in cash flows. Inventory units on hand were lower in 2010 than

2009 reflecting differences in purchases and actual versus expected sales in the respective periods.

• Changes in accounts payable required $18.6 million in 2010 and provided $52.6 million in 2009

causing a year-over-year decrease in cash flows of $71.2 million. Changes in accounts payable were

driven primarily by payment timing differences.

• A $16.2 million increase in income tax payments. Income tax payments, net of refunds, were

$53.1 million and $36.9 million in 2010 and 2009, respectively.

• The change in Accrued taxes during 2010 includes an outflow of approximately $25 million related to

sales tax payments made during 2010 related to prior years. U.S. Cellular had accrued these sales

taxes at December 31, 2009. The 2009 period does not include a similar outflow related to the

retroactive payment of sales taxes.

• Changes in other assets and liabilities provided $79.5 million in 2010 and required $51.1 million in

2009, resulting in a $130.7 million year-over-year increase in cash flows. In 2009, a $34.0 million

deposit was paid to TDS for U.S. Cellular’s proportionate share of a deposit TDS made to the Internal

Revenue Service (‘‘IRS’’) to eliminate any potential interest due to the IRS subsequent to the date of

the deposit. In 2010, after closure of the IRS audit for the tax years 2002 through 2005, the IRS

returned TDS’ $38.0 million deposit, of which TDS returned $34.0 million to U.S. Cellular, representing

U.S. Cellular’s proportionate share. This $34.0 million was included in Change in other assets and

liabilities in 2010, as a cash inflow, and in 2009, as a cash outflow. This activity resulted in a year-over

year increase in cash flows of $68.0 million from 2009 to 2010. In addition to this $68.0 million change,

changes in prepaid expenses, other current liabilities and amounts due to agents were the primary

cause of the remaining $62.7 million year-over-year change in other assets and liabilities.

13