US Cellular 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Equipment sales revenues

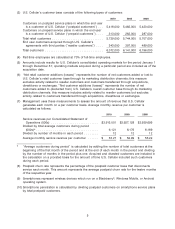

Equipment sales revenues include revenues from sales of wireless devices (handsets, modems and

tablets) and related accessories to both new and existing customers, as well as revenues from sales of

wireless devices and accessories to agents. All equipment sales revenues are recorded net of rebates.

U.S. Cellular strives to offer a competitive line of quality wireless devices to both new and existing

customers. U.S. Cellular’s customer acquisition and retention efforts include offering new wireless

devices to customers at discounted prices; in addition, customers on the new Belief Plans receive loyalty

reward points that may be used to purchase a new wireless device or accelerate the timing of a

customer’s eligibility for a wireless device upgrade at promotional pricing. U.S. Cellular also continues to

sell wireless devices to agents; this practice enables U.S. Cellular to provide better control over the

quality of wireless devices sold to its customers, establish roaming preferences and earn quantity

discounts from wireless device manufacturers which are passed along to agents. U.S. Cellular anticipates

that it will continue to sell wireless devices to agents in the future.

The decrease in 2010 equipment sales revenues was driven by declines of 5% in total wireless devices

sold and a 5% decrease in average revenue per wireless device sold. Average revenue per wireless

device sold declined due to aggressive promotional pricing across all categories of wireless devices. The

decrease in 2009 equipment sales revenues was driven by a decline of 8% in average revenue per

wireless device sold due to aggressive promotional pricing across all categories of wireless devices,

partially offset by an increase in the total number of wireless devices sold.

Operating Expenses

System operations expenses (excluding Depreciation, amortization and accretion)

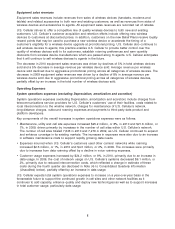

System operations expenses (excluding Depreciation, amortization and accretion) include charges from

telecommunications service providers for U.S. Cellular’s customers’ use of their facilities, costs related to

local interconnection to the wireline network, charges for maintenance of U.S. Cellular’s network,

long-distance charges, outbound roaming expenses and payments to third-party data product and

platform developers.

Key components of the overall increases in system operations expenses were as follows:

• Maintenance, utility and cell site expenses increased $25.2 million, or 8%, in 2010 and $21.6 million, or

7%, in 2009, driven primarily by increases in the number of cell sites within U.S. Cellular’s network.

The number of cell sites totaled 7,645 in 2010 and 7,279 in 2009, as U.S. Cellular continued to expand

and enhance coverage in its existing markets. The increases in expenses were also due to an increase

in software maintenance costs to support rapidly growing data needs.

• Expenses incurred when U.S. Cellular’s customers used other carriers’ networks while roaming

increased $2.6 million, or 1%, in 2010 and $4.3 million, or 2%, in 2009. The increases were primarily

due to increases from data roaming offset by a decline in voice roaming expenses.

• Customer usage expenses increased by $24.2 million, or 9%, in 2010, primarily due to an increase in

data usage. In 2009, the cost of network usage on U.S. Cellular’s systems decreased $6.1 million, or

2%, primarily due to reduced interconnection costs, which reflected a change in estimate of these

costs during the fourth quarter (as disclosed in Note (4) to Consolidated Quarterly Information

(Unaudited) below), partially offset by an increase in data usage.

U.S. Cellular expects total system operations expenses to increase on a year-over-year basis in the

foreseeable future to support the continued growth in cell sites and other network facilities as it

continues to add capacity, enhance quality and deploy new technologies as well as to support increases

in total customer usage, particularly data usage.

8