US Cellular 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Depreciation, amortization and accretion

Depreciation, amortization and accretion remained relatively flat in 2010, 2009 and 2008.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ for a discussion of U.S. Cellular’s

capital expenditures.

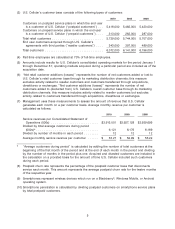

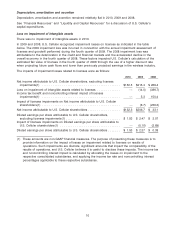

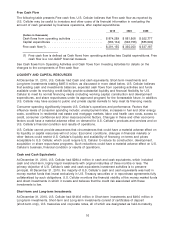

Loss on impairment of intangible assets

There was no impairment of intangible assets in 2010.

In 2009 and 2008, U.S. Cellular recognized impairment losses on licenses as indicated in the table

below. The 2009 impairment loss was incurred in connection with the annual impairment assessment of

licenses and goodwill performed during the fourth quarter of 2009. The 2008 impairment loss was

attributable to the deterioration in the credit and financial markets and the accelerated decline in the

overall economy in the fourth quarter of 2008. These factors impacted U.S. Cellular’s calculation of the

estimated fair value of licenses in the fourth quarter of 2008 through the use of a higher discount rate

when projecting future cash flows and lower than previously projected earnings in the wireless industry.

The impacts of impairment losses related to licenses were as follows:

2010 2009 2008

Net income attributable to U.S. Cellular shareholders, excluding licenses

impairments(1) ........................................... $132.3 $215.4 $ 269.4

Loss on impairment of intangible assets related to licenses ............. — (14.0) (386.7)

Income tax benefit and noncontrolling interest impact of licenses

impairments(1) ........................................... — 5.3 150.4

Impact of licenses impairments on Net income attributable to U.S. Cellular

shareholders(1) ........................................... — (8.7) (236.3)

Net income attributable to U.S. Cellular shareholders .................. $132.3 $206.7 $ 33.1

Diluted earnings per share attributable to U.S. Cellular shareholders,

excluding licenses impairments(1) .............................. $ 1.53 $ 2.47 $ 3.07

Impact of licenses impairments on Diluted earnings per share attributable to

U.S. Cellular shareholders(1) ................................. — (0.10) (2.69)

Diluted earnings per share attributable to U.S. Cellular shareholders ....... $ 1.53 $ 2.37 $ 0.38

(1) These amounts are non-GAAP financial measures. The purpose of presenting these measures is to

provide information on the impact of losses on impairment related to licenses on results of

operations. Such impairments are discrete, significant amounts that impact the comparability of the

results of operations, and U.S. Cellular believes it is useful to disclose these impacts. The income tax

and noncontrolling interest impact is calculated by allocating the losses on impairment to the

respective consolidated subsidiaries, and applying the income tax rate and noncontrolling interest

percentages applicable to these respective subsidiaries.

10