US Cellular 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

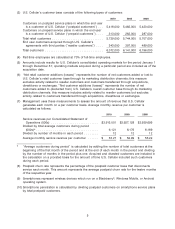

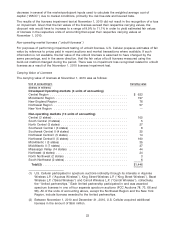

Acquisitions required cash payments of $17.1 million in 2010, $16.0 million in 2009 and $341.7 million in

2008, as summarized below:

Cash Payment for Acquisitions(1) 2010 2009 2008

(Dollars in millions)

Auction 73 licenses(2) .................................... $ — $ — $300.5

All other licenses ....................................... 17.1 15.8 32.3

Business acquisitions .................................... — — 8.9

All other .............................................. — 0.2 —

Total ................................................ $17.1 $16.0 $341.7

(1) Cash amounts paid for the acquisitions may differ from the purchase price due to cash acquired

in the transactions and cash payments remitted in periods subsequent to the respective

transactions.

(2) King Street Wireless L.P., an entity in which a subsidiary of U.S. Cellular is a limited partner,

made these payments. U.S. Cellular loaned these funds to the partnership and the general

partner and made direct capital investments to fund the auction payment.

In 2010, U.S. Cellular invested $250.3 million in U.S. treasuries and corporate notes with maturities

greater than three months from the acquisition date. U.S. Cellular realized cash proceeds of $60.3 million

in 2010 related to the maturities of its investments in U.S. treasuries, corporate notes and CDs.

In 2008, U.S. Cellular realized cash proceeds of $16.7 million from the disposition of Rural Cellular

Corporation (‘‘RCC’’) Common Shares in conjunction with Verizon Wireless’ acquisition of RCC.

Cash Flows from Financing Activities

Cash flows from financing activities primarily reflect changes in short-term and long-term debt balances,

distributions to noncontrolling interests, cash used to repurchase Common Shares and cash proceeds

from re-issuance of Common Shares pursuant to stock-based compensation plans. U.S. Cellular has

used short-term debt to finance acquisitions, for general corporate purposes and to repurchase Common

Shares. Internally generated funds as well as proceeds from the sale of non-strategic wireless and other

investments, from time to time, have been used to reduce short-term debt.

There were no short-term borrowings or repayments during 2010 or 2009. Cash received from short-term

borrowings under U.S. Cellular’s revolving credit facility provided $100.0 million in 2008, while

repayments required $100.0 million in 2008.

In 2009, U.S. Cellular redeemed its outstanding 8.75% senior notes for their principal amount of

$130.0 million and retired its 9% installment notes payable in the amount of $10.0 million. There were no

redemptions of long-term debt in 2010 or 2008.

U.S. Cellular repurchased Common Shares for $52.8 million, $33.6 million and $32.9 million in 2010,

2009 and 2008, respectively. U.S. Cellular also received $4.6 million in 2008 from an investment banking

firm for the final settlement of Accelerated Share Repurchases (‘‘ASR’’) made in 2007. See Note 14—

Common Shareholders’ Equity in the Notes to Consolidated Financial Statements for additional

information related to these transactions.

15