US Cellular 2010 Annual Report Download - page 15

Download and view the complete annual report

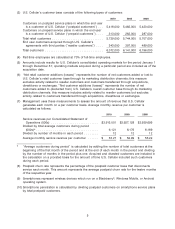

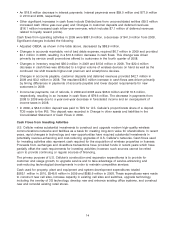

Please find page 15 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Average monthly retail service revenue per customer increased slightly to $47.10 in 2010 from $46.93 in

2009, and in 2009 increased 1% from $ 46.45 in 2008. The 2010 and 2009 increases in average monthly

retail service revenue per customer include the impact of a reduction in the number of reseller

customers, who typically generate lower average monthly revenues.

U.S. Cellular expects continued pressure on revenues in the foreseeable future due to industry

competition for customers and related effects on pricing of service plan offerings.

As discussed in the Overview section above, on October 1, 2010, U.S. Cellular introduced The Belief

Project, which allows customers selecting Belief Plans to earn loyalty reward points. U.S. Cellular will

account for loyalty reward points under the deferred revenue method. Under this method, U.S. Cellular

will allocate a portion of the revenue billed to customers under the Belief Plans to the loyalty reward

points. The revenue allocated to these points will initially be deferred on the Consolidated Balance Sheet

to be recognized in future periods when the loyalty reward points are redeemed or used. Application of

the deferred revenue method of accounting related to loyalty reward points resulted in deferred revenues

of $7.1 million in 2010. This amount is included in the Consolidated Balance Sheet at December 31,

2010 in Customer deposits and deferred revenues.

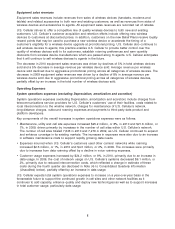

Inbound roaming revenues

Inbound roaming revenues were essentially flat in 2010 compared to 2009 as an increase in revenues

from data roaming offset a decline in voice roaming revenues.

In 2009, the decrease in Inbound roaming revenues was primarily due to the decline in roaming

revenues from the combined entity of Verizon and Alltel. In January 2009, Verizon acquired Alltel. As a

result of this transaction, the network footprints of Verizon and Alltel were combined. This has resulted in

a decrease in inbound roaming revenues for U.S. Cellular, since the combined Verizon and Alltel entity

has reduced its usage of U.S. Cellular’s network in certain coverage areas that were used by Verizon and

Alltel (as separate entities). U.S. Cellular anticipates that inbound roaming revenues will increase in 2011

compared to 2010 due to the growth of data usage and voice minutes from U.S. Cellular’s roaming

partners that will more than offset expected decreases in voice and data rates.

Other revenues

Other revenues increased by $4.0 million, or 2%, in 2010 compared to 2009. A decrease in ETC

revenues was offset by increases in other revenues from tower and spectrum leases. The decrease in

ETC revenues in 2010 was primarily the result of a retroactive adjustment made by the Universal Service

Administrative Company that resulted in a reduction of revenues of $3.6 million. The increase in Other

revenues in 2009 compared to 2008 was primarily due to an increase in amounts that were received

from the USF for states in which U.S. Cellular has been designated as an ETC. U.S. Cellular was eligible

to receive ETC funds in sixteen states in 2010, 2009 and 2008. ETC revenues recorded in 2010, 2009

and 2008 were $143.9 million, $150.7 million and $134.1 million, respectively.

In May 2008, the FCC adopted a state-by-state temporary cap to funding for competitive ETCs based on

the funding level available as of March 31, 2008. The cap has had the effect of reducing the amount of

support that U.S. Cellular would otherwise have been eligible to receive. The cap funding level is

undergoing revision because of the time lag in the reporting of costs by local exchange carriers which,

under the ‘‘identical support rule,’’ provides the amount of per line support that wireless ETCs are

entitled to receive. This revision may further reduce funding under the cap and may result in a recapture

of some payments that U.S. Cellular has received in excess of the cap. In October 2010, the FCC

proposed creating a $100-300 million Mobility Fund to subsidize on a one time basis new wireless

broadband development in unserved areas, with reverse auctions to award subsidies to low bidders. On

February 8, 2011, the FCC issued a notice of proposed rulemaking to consider reform of the USF

program in response to the issuance of the National Broadband Plan in March 2010. Creation of the

Mobility Fund and adoption of a USF reform proposal by the FCC to transition support from voice

networks to broadband networks could have a significant and adverse impact on the amount of support,

if any, wireless ETCs continue to receive. As a result, U.S. Cellular’s ETC revenues may decline

significantly in future periods.

7