US Cellular 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 14 COMMON SHAREHOLDERS’ EQUITY (Continued)

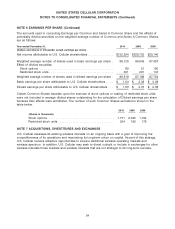

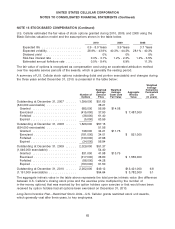

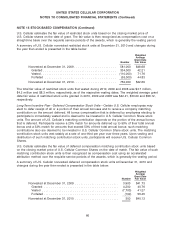

Share repurchases made under this authorization and prior authorizations, were as follows:

Number of Average Cost

Year Ended December 31, Shares Per Share Amount

(Dollars and share amounts in thousands)

2010

U.S. Cellular Common Shares .............. 1,235 $42.76 $52,827

2009

U.S. Cellular Common Shares .............. 887 $37.86 $33,585

2008

U.S. Cellular Common Shares .............. 600 $54.87 $32,920

Pursuant to certain employee and non-employee benefit plans, U.S. Cellular reissued 241,954, 147,414

and 283,567 Treasury Shares in 2010, 2009 and 2008, respectively.

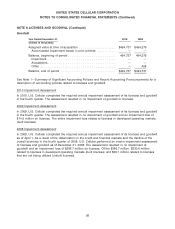

NOTE 15 STOCK-BASED COMPENSATION

U.S. Cellular has established the following stock-based compensation plans: a long-term incentive plan,

an employee stock purchase plan, and a non-employee director compensation plan. Also, U.S. Cellular

employees are eligible to participate in the TDS employee stock purchase plan.

Under the U.S. Cellular 2005 Long-Term Incentive Plan, U.S. Cellular may grant fixed and performance-

based incentive and non-qualified stock options, restricted stock, restricted stock units, and deferred

compensation stock unit awards to key employees. At December 31, 2010, the only types of awards

outstanding are fixed non-qualified stock option awards, restricted stock unit awards, and deferred

compensation stock unit awards.

At December 31, 2010, U.S. Cellular had reserved 6,081,000 Common Shares for equity awards granted

and to be granted under the 2005 Long-Term Incentive Plan, and also had reserved 35,000 Common

Shares for issuance to employees under an employee stock purchase plan. The maximum number of

U.S. Cellular Common Shares that may be issued to employees under all stock-based compensation

plans in effect at December 31, 2010, was 6,116,000.

U.S. Cellular also has established a Non-Employee Director Compensation Plan under which it has

reserved 39,000 Common Shares for issuance as compensation to members of the Board of Directors

who are not employees of U.S. Cellular or TDS.

U.S. Cellular uses treasury stock to satisfy requirements for Common Shares issued pursuant to its

various stock-based compensation plans.

Long-Term Incentive Plan—Stock Options—Stock options granted to key employees are exercisable over

a specified period not in excess of ten years. Stock options generally vest over periods of between three

and four years from the date of grant. Stock options outstanding at December 31, 2010 expire between

2011 and 2020. However, vested stock options typically expire 30 days after the effective date of an

employee’s termination of employment for reasons other than retirement. Employees who leave at the

age of retirement have 90 days (or one year if they satisfy certain requirements) within which to exercise

their vested stock options. The exercise price of the option generally equals the market value of

U.S. Cellular Common Shares on the date of grant.

64