US Cellular 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

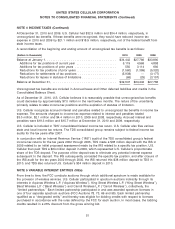

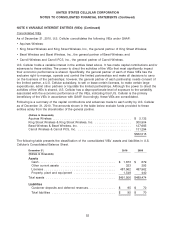

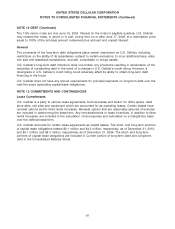

NOTE 5 VARIABLE INTEREST ENTITIES (VIEs) (Continued)

Other Related Matters

U.S. Cellular may agree to make additional capital contributions and/or advances to the VIEs discussed

above and/or to their general partners to provide additional funding for the development of licenses

granted in the various auctions. U.S. Cellular may finance such amounts with a combination of cash on

hand, borrowings under its revolving credit agreement and/or long-term debt. There is no assurance that

U.S. Cellular will be able to obtain additional financing on commercially reasonable terms or at all to

provide such financial support.

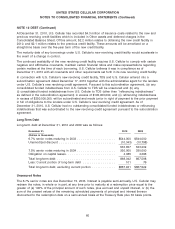

The limited partnership agreements also provide the general partner with a put option whereby the

general partner may require the limited partner, a subsidiary of U.S. Cellular, to purchase its interest in

the limited partnership. The general partner’s put options related to its interests in Carroll Wireless, Barat

Wireless, King Street Wireless and Aquinas Wireless will become exercisable in 2013, 2017, 2019 and

2020, respectively. The put option price is determined pursuant to a formula that takes into consideration

fixed interest rates and the market value of U.S. Cellular’s Common Shares. Upon exercise of the put

option, the general partner is required to repay borrowings due to U.S. Cellular. If the general partner

does not elect to exercise its put option, the general partner may trigger an appraisal process in which

the limited partner (a subsidiary of U.S. Cellular) may have the right, but not the obligation, to purchase

the general partner’s interest in the limited partnership at a price and on other terms and conditions

specified in the limited partnership agreement. In accordance with requirements under GAAP, U.S.

Cellular is required to calculate a theoretical redemption value for all of the puts assuming they are

exercisable at the end of each reporting period, even though such exercise is not contractually

permitted. Pursuant to GAAP, this theoretical redemption value, net of amounts payable to U.S. Cellular

for loans (and accrued interest thereon) made by U.S. Cellular to the general partners, is recorded as

Noncontrolling interests with redemption features in U.S. Cellular’s Consolidated Balance Sheet. Also in

accordance with GAAP, changes in the redemption value of the put options, net of interest accrued on

the loans, are recorded as a component of Net income attributable to noncontrolling interests, net of tax,

in U.S. Cellular’s Consolidated Statements of Operations.

These VIEs are in the process of developing Long-Term Evolution (‘‘LTE’’) deployment plans. These

entities were formed to participate in FCC auctions of wireless spectrum and to fund, establish, and

provide wireless service with respect to any FCC licenses won in the auctions. As such, these entities

have risks similar to those described in the ‘‘Risk Factors’’ in U.S. Cellular’s Annual Report on Form 10-K.

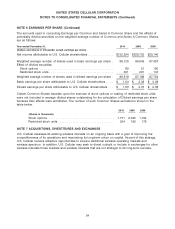

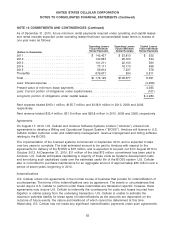

NOTE 6 EARNINGS PER SHARE

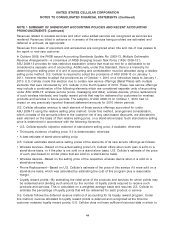

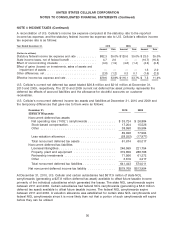

Basic earnings per share attributable to U.S. Cellular shareholders is computed by dividing Net income

attributable to U.S. Cellular shareholders by the weighted average number of common shares

outstanding during the period. Diluted earnings per share attributable to U.S. Cellular shareholders is

computed by dividing Net income attributable to U.S. Cellular shareholders by the weighted average

number of common shares outstanding during the period adjusted to include the effects of potentially

dilutive securities. Potentially dilutive securities primarily include incremental shares issuable upon

exercise of outstanding stock options and the vesting of restricted stock units.

53