US Cellular 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

Advertising Costs

U.S. Cellular expenses advertising costs as incurred. Advertising costs totaled $265.2 million,

$256.9 million and $277.8 million for 2010, 2009 and 2008, respectively.

Income Taxes

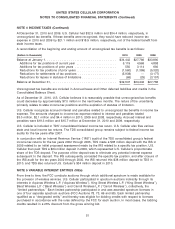

U.S. Cellular is included in a consolidated federal income tax return with other members of the TDS

consolidated group. TDS and U.S. Cellular are parties to a Tax Allocation Agreement which provides that

U.S. Cellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal

income tax return and in state income or franchise tax returns in certain situations. For financial

statement purposes, U.S. Cellular and its subsidiaries calculate their income, income taxes and credits as

if they comprised a separate affiliated group. Under the Tax Allocation Agreement, U.S. Cellular remits its

applicable income tax payments to TDS. U.S. Cellular had a tax receivable balance with TDS of

$40.8 million and a tax payable balance of $1.7 million as of December 31, 2010 and 2009, respectively.

Deferred taxes are computed using the liability method, whereby deferred tax assets are recognized for

future deductible temporary differences and operating loss carryforwards, and deferred tax liabilities are

recognized for future taxable temporary differences. Both deferred tax assets and liabilities are measured

using the tax rates anticipated to be in effect when the temporary differences reverse. Temporary

differences are the differences between the reported amounts of assets and liabilities and their tax bases.

Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the

date of enactment. Deferred tax assets are reduced by a valuation allowance when it is more likely than

not that some portion or all of the deferred tax assets will not be realized. U.S. Cellular evaluates income

tax uncertainties, assesses the probability of the ultimate settlement with the applicable taxing authority

and records an amount based on that assessment.

Stock-Based Compensation

U.S. Cellular has established a long-term incentive plan, an employee stock purchase plan, and a

non-employee director compensation plan. Also, U.S. Cellular employees are eligible to participate in the

TDS employee stock purchase plan. These plans are described more fully in Note 15—Stock-based

Compensation. These plans are considered compensatory plans; therefore, recognition of compensation

cost for grants made under these plans is required.

U.S. Cellular values its share-based payment transactions using a Black-Scholes valuation model. Stock-

based compensation cost recognized during the period is based on the portion of the share-based

payment awards that is ultimately expected to vest. Accordingly, stock-based compensation cost

recognized has been reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and

revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. Pre-vesting

forfeitures and expected life are estimated based on historical experience related to similar awards,

giving consideration to the contractual terms of the stock-based awards, vesting schedules and

expectations of future employee behavior. U.S. Cellular believes that its historical experience provides the

best estimates of future pre-vesting forfeitures and future expected life. The expected volatility

assumption is based on the historical volatility of U.S. Cellular’s common stock over a period

commensurate with the expected life. The dividend yield assumption is zero because U.S. Cellular has

never paid a dividend and has expressed its intention to retain all future earnings in the business. The

risk-free interest rate assumption is determined using the implied yield for zero-coupon U.S. government

issues with a remaining term that approximates the expected life of the stock options.

Compensation cost for stock option awards is recognized over the respective requisite service period of

the awards, which is generally the vesting period, on a straight-line basis for each separate vesting

46