US Cellular 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

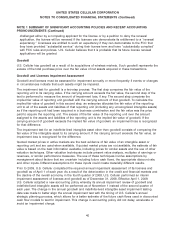

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

combinations are to be accounted for at fair value in accordance with the acquisition method, they

require U.S. Cellular to revise its application of the acquisition method in a number of significant aspects.

Specifically, the new provisions require that transaction costs are to be expensed and that the acquirer

must recognize 100% of the acquiree’s assets and liabilities rather than a proportional share, for

acquisitions of less than 100% of a business. In addition, the revised provisions eliminate the step

acquisition model and provide that all business combinations, whether full, partial or step acquisitions,

will result in all assets and liabilities of an acquired business being recorded at their fair values at the

acquisition date.

During 2008, U.S. Cellular applied the provisions of GAAP related to business combinations in effect

during that period. Similar to the revised provisions, the previous provisions required the application of

the acquisition method whereby business combinations were to be accounted for at fair value. However,

the previous provisions were different in a number of respects, including (but not limited to) the

requirement that all direct and incremental costs relating to an acquisition be included in the acquisition

costs, and the requirement that the acquirer only recognize its proportional share of the fair value of

assets and liabilities acquired in a partial business acquisition.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to

make estimates and assumptions that affect (a) the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and (b) the reported

amounts of revenues and expenses during the reported period. Actual results could differ from those

estimates. Significant estimates are involved in accounting for goodwill and indefinite-lived intangible

assets, depreciation, amortization and accretion, allowance for doubtful accounts, loyalty reward points,

and income taxes.

Cash and Cash Equivalents

Cash and cash equivalents include cash and short-term, highly liquid investments with original maturities

of three months or less.

Outstanding checks totaled $17.5 million and $21.0 million at December 31, 2010 and 2009, respectively,

and are classified as Accounts payable-Trade in the Consolidated Balance Sheet.

Short-Term and Long-Term Investments

As of December 31, 2010 and 2009, U.S. Cellular had $146.6 million and $0.3 million in Short-term

investments and $46.0 million and $0 in Long-term investments, respectively. Short-term and Long-term

investments consist of certificates of deposit (short-term only), U.S. treasuries and corporate notes, all of

which are designated as held-to-maturity investments, and are recorded at amortized cost in the

Consolidated Balance Sheet. The corporate notes are guaranteed by the Federal Deposit Insurance

Corporation. For these investments, U.S. Cellular’s objective is to earn a higher rate of return on funds

that are not anticipated to be required to meet liquidity needs in the near term, while maintaining a low

level of investment risk. See Note 3—Fair Value Measurements in the Notes to Consolidated Financial

Statements for additional details on Short-term and Long-term investments.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable primarily consist of amounts owed by customers pursuant to service contracts and

for equipment sales, by agents for sales of equipment to them and by other wireless carriers whose

customers have used U.S. Cellular’s wireless systems.

38