TCF Bank 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

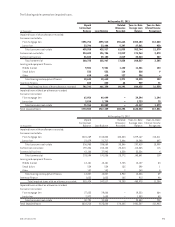

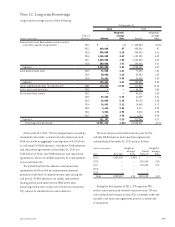

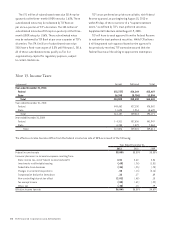

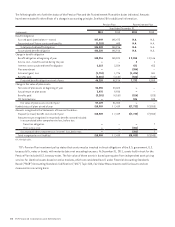

Note 12. Long-term Borrowings

Long-term borrowings consist of the following.

At December 31,

2011 2010

(Dollars in thousands)

Year of

Maturity Amount

Weighted-

average

Rate Amount

Weighted-

average

Rate

Federal Home Loan Bank advances and securities

sold under repurchase agreements 2011 $ – – % $ 300,000 4.64%

2013 400,000 .97 400,000 .97

2015 900,000 4.18 900,000 4.18

2016 1,100,000 4.49 1,100,000 4.49

2017 1,250,000 4.60 1,250,000 4.60

2018 300,000 3.51 300,000 3.51

Subtotal 3,950,000 4.02 4,250,000 4.07

Subordinated bank notes 2014 71,020 2.21 71,020 1.96

2015 50,000 2.14 50,000 1.89

2016 74,661 5.63 74,589 5.63

Subtotal 195,681 3.49 195,609 3.34

Junior subordinated notes (trust preferred) 2068 114,236 12.83 111,061 12.28

Senior unsecured term note 2012 – – 89,787 3.83

Discounted lease rentals 2011 – – 84,101 5.30

2012 57,622 5.32 61,829 5.31

2013 36,009 5.28 39,155 5.28

2014 16,641 5.12 16,463 5.12

2015 5,662 5.04 5,211 5.02

2016 4,026 4.98 3,818 4.98

2017 1,787 4.98 1,787 4.98

Subtotal 121,747 5.25 212,364 5.27

Total long-term borrowings $4,381,664 4.26% $4,858,821 4.27%

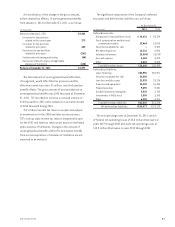

At December 31, 2011, TCF has pledged loans secured by

residential real estate, commercial real estate loans and

FHLB stock with an aggregate carrying value of $6.9 billion

as collateral for FHLB advances. Included in FHLB advances

and repurchase agreements at December 31, 2011 are

$300 million of fixed-rate FHLB advances and repurchase

agreements, which are callable quarterly by counterparties

at par until maturity.

The probability that the advances and repurchase

agreements will be called by counterparties depends

primarily on the level of related interest rates during the

call period. If FHLB advances are called, replacement

funding will be available from the FHLB at the then-

prevailing market rate of interest for the term selected by

TCF, subject to standard terms and conditions.

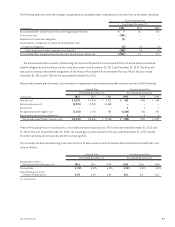

The next call year and stated maturity year for the

callable FHLB advances and repurchase agreements

outstanding at December 31, 2011 were as follows.

(Dollars in thousands)

Year Next Call

Weighted-

average

Rate

Stated

Maturity

Weighted-

average

Rate

2012 $300,000 4.04% $ – – %

2015 – – 200,000 3.88

2017 – – 100,000 4.37

2018 – – – –

2019 – – – –

Total $300,000 4.04 $300,000 4.04

During the first quarter of 2011, TCF repaid its $90

million senior unsecured variable-rate term note. TCF was

not in default with respect to any of its covenants under the

variable-rate term note agreement prior to or at the time

of repayment.

792011 Form 10-K