TCF Bank 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

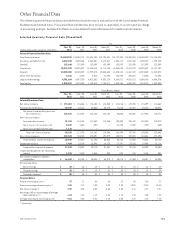

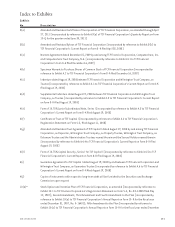

Other Financial Data

The selected quarterly financial data presented below should be read in conjunction with the Consolidated Financial

Statements and related notes. Prior period financial data has been revised, as applicable, for a retrospective change

in accounting principle. See Note 28 of Notes to Consolidated Financial Statements for additional information.

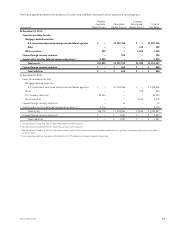

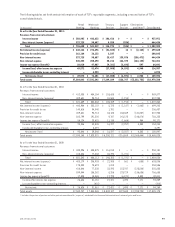

Selected Quarterly Financial Data (Unaudited)

At

(Dollars in thousands, except per-share data)

Dec. 31,

2011

Sept. 30,

2011

June 30,

2011

March 31,

2011

Dec. 31,

2010

Sept. 30,

2010

June 30,

2010

March 31,

2010

Selected Financial Condition Data:

Total loans and leases $14,150,255 $14,339,715 $14,631,945 $14,796,541 $14,788,304 $14,896,601 $14,639,893 $14,706,423

Securities available for sale 2,324,038 2,600,806 2,463,367 2,172,017 1,931,174 1,947,462 1,940,331 1,899,825

Goodwill 225,640 152,599 152,599 152,599 152,599 152,599 152,599 152,599

Total assets 18,979,388 19,092,027 18,834,416 18,712,136 18,465,025 18,312,978 18,029,622 18,187,102

Deposits 12,202,004 12,320,502 11,939,476 12,043,684 11,585,115 11,461,519 11,523,043 11,882,373

Short-term borrowings 6,416 7,204 9,514 12,898 126,790 344,681 14,805 17,590

Long-term borrowings 4,381,664 4,397,750 4,415,362 4,533,176 4,858,821 4,581,511 4,600,820 4,496,574

Total equity 1,878,627 1,872,044 1,769,619 1,724,471 1,480,163 1,505,327 1,474,113 1,393,405

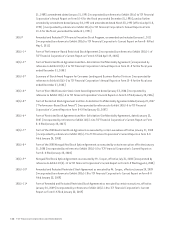

Three Months Ended

Dec. 31,

2011

Sept. 30,

2011

June 30,

2011

March 31,

2011

Dec. 31,

2010

Sept. 30,

2010

June 30,

2010

March 31,

2010

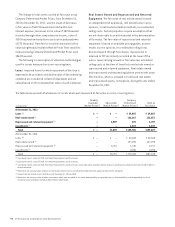

Selected Operations Data:

Net interest income $ 173,434 $ 176,064 $ 176,150 $ 174,040 $ 174,286 $ 173,755 $ 176,499 $ 174,662

Provision for credit losses 59,249 52,315 44,005 45,274 77,646 59,287 49,013 50,491

Net interest income after provision

for credit losses 114,185 123,749 132,145 128,766 96,640 114,468 127,486 124,171

Non-interest income:

Fees and other revenue 91,315 116,108 114,369 114,246 120,309 129,437 136,043 123,073

Gains (losses) on securities, net 5,842 1,648 (227) – 21,185 8,505 (137) (430)

Gains on auto loans held for sale 1,133 – – – – – – –

Total non-interest income 98,290 117,756 114,142 114,246 141,494 137,942 135,906 122,643

Non-interest expense 187,533 188,848 195,091 192,979 185,972 190,908 188,361 191,094

Income before income tax expense 24,942 52,657 51,196 50,033 52,162 61,502 75,031 55,720

Income tax expense 7,424 19,159 19,086 18,772 17,391 23,226 28,438 21,116

Income after income tax expense 17,518 33,498 32,110 31,261 34,771 38,276 46,593 34,604

Income attributable to non-controlling

interest 1,075 1,243 1,686 989 898 912 1,186 301

Net income available to common

stockholders $ 16,443 $ 32,255 $ 30,424 $ 30,272 $ 33,873 $ 37,364 $ 45,407 $ 34,303

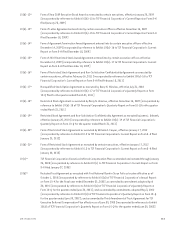

Per common share:

Basic earnings $ .10 $ .20 $ .19 $ .21 $ .24 $ .26 $ .32 $ .26

Diluted earnings $ .10 $ .20 $ .19 $ .21 $ .24 $ .26 $ .32 $ .26

Dividends declared $ .05 $ .05 $ .05 $ .05 $ .05 $ .05 $ .05 $ .05

Financial Ratios:

Return on average assets (1) .37 .71 .68 .68 .75 .85 1.03 .77

Return on average common equity (1) 3.55 7.12 7.00 8.00 9.09 10.08 12.82 10.80

Net interest margin (1) 3.92 3.96 4.02 4.06 4.05 4.14 4.19 4.21

Net charge-offs as a percentage of average

loans and leases (1) 1.63 1.48 1.19 1.51 1.75 1.58 1.30 1.22

Average total equity to average assets 9.81 9.58 9.32 8.24 8.05 8.28 7.88 7.10

(1) Annualized.

1032011 Form 10-K