TCF Bank 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

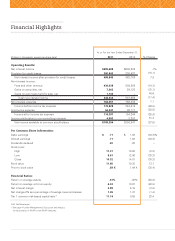

08 TCF Financial Corporation and Subsidiaries

Revenue

TCF’s total revenue in 2011 was $1.1

billion, down 8 percent from last year

with net interest income remaining flat

and non-interest income decreasing

17 percent.

Banking fees and service charges

declined 20 percent from 2010 primarily

due to the full annual impact in 2011

of Regulation E, the opt-in regulations

regarding ATM transactions and

one-time debit card transactions that

became effective in August 2010. While

I feel TCF did a good job educating

customers on opt-in, this regulation still

had a sizeable impact on overdraft

revenue in 2011. The full impact is

now built in and the opt-in initiative is

largely behind us. The fee revenue lost

to Regulation E was partially offset

by the implementation of monthly

maintenance fees for retail customers

not meeting certain account criteria. In

late 2011, we implemented the new

fee waiver criteria which included a

minimum of 15 qualifying transactions

per month to waive the monthly

maintenance fee. This product is

different than many of our competitors.

Instead of requiring a high minimum

balance, we are just asking that our

customers simply use their account.

TCF’s card revenue of $96.1 million in

2011 was down 13 percent from 2010,

which was attributable to the imple-

mentation of the Durbin Amendment

in October 2011. The impact of the

Durbin Amendment in the fourth

quarter of 2011 resulted in decreased

revenue of $14.7 million.

Leasing and equipment finance

continued to be an important revenue

source for TCF in 2011. These revenues

totaled $89.2 million, which remained

flat compared with 2010.

Expenses

TCF’s operating expenses were again

very well controlled in 2011. We

continued to streamline our business

processes and operations to make

them as efficient as possible. Our new

functionally organized management

structure will provide more opportuni-

ties for TCF to improve efficiencies

and reduce operating expenses

moving forward. During the third

quarter of 2011, TCF discontinued its

debit card reward program as a result

of the implementation of the Durbin

Amendment. We continue to look

for additional expense savings opportu-

nities as a way to help contribute to

the bottom line in the challenging

economic and regulatory environment.

Non-Interest expense totaled $764.5

million in 2011, up slightly from 2010. We

saw increased FDIC insurance expenses

related to changes in the rate calculations

for banks over $10 billion in total assets,

which were implemented in April 2011.

Foreclosed real estate and repossessed

asset expenses also increased in 2011

primarily due to valuation writedowns

on commercial real estate.

Even during this difficult operating

environment, TCF remains committed

to the ongoing professional develop-

ment of its employees and continues to

recognize and motivate hard working

individuals through job promotions,

incentive compensation, tuition

reimbursement and other reward

1110090807

$278

$271

$287

$273

$219

Fees & Service Charges

Millions of Dollars

Fees & Other Revenue

$1,092

$1,092

$1,159

$1, 237

$1,144

Net Interest Income

1110090807

Total Revenue

Millions of Dollars