TCF Bank 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

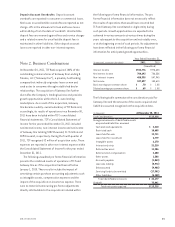

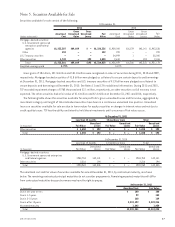

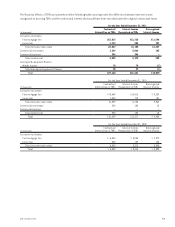

Note 5. Securities Available for Sale

Securities available for sale consist of the following.

At December 31,

2011 2010

(Dollars in thousands)

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal

agencies $2,233,307 $89,029 $ – $2,322,336 $1,929,098 $16,579 $42,141 $1,903,536

Other 152 – – 152 222 – – 222

U.S. Treasury securities – – – – 24,999 1 – 25,000

Other securities 1,742 – 192 1,550 2,610 – 194 2,416

Total $2,235,201 $89,029 $192 $2,324,038 $1,956,929 $16,580 $42,335 $1,931,174

Weighted-average yield 3.79% 3.87%

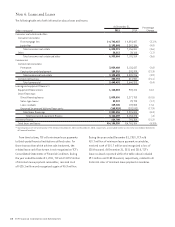

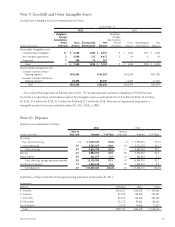

Gross gains of $8 million, $31.5 million and $31.8 million were recognized on sales of securities during 2011, 2010 and 2009,

respectively. Mortgage-backed securities of $1.8 billion were pledged as collateral to secure certain deposits and borrowings

at December 31, 2011. Mortgage-backed securities and U.S. treasury securities of $1.9 billion were pledged as collateral to

secure deposits and borrowings at December 31, 2010. See Notes 11 and 12 for additional information. During 2011 and 2010,

TCF recorded impairment charges of $768 thousand and $2.1 million, respectively, on other securities as full recovery is not

expected. The other securities had a fair value of $1.6 million and $2.4 million at December 31, 2011 and 2010, respectively.

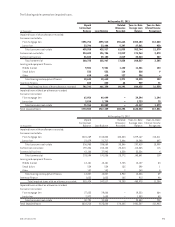

The following table shows the securities available for sale portfolio’s gross unrealized losses and fair value, aggregated by

investment category and length of time individual securities have been in a continuous unrealized loss position. Unrealized

losses on securities available for sale are due to lower values for equity securities or changes in interest rates and not due to

credit quality issues. TCF has the ability and intent to hold these investments until a recovery of fair value occurs.

At December 31, 2011

Less than 12 months 12 months or more Total

(In thousands) Fair Value Unrealized

Losses Fair Value Unrealized

Losses Fair Value Unrealized

Losses

Other securities $ 1,450 $ 192 $ – $ – $ 1,450 $ 192

Total $ 1,450 $ 192 $ – $ – $ 1,450 $ 192

At December 31, 2010

Less than 12 months 12 months or more Total

(In thousands) Fair Value Unrealized

Losses Fair Value Unrealized

Losses Fair Value Unrealized

Losses

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $988,753 $42,141 $ – $ – $988,753 $42,141

Other securities 2,216 194 – – 2,216 194

Total $990,969 $42,335 $ – $ – $990,969 $42,335

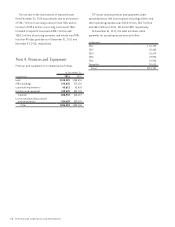

The amortized cost and fair value of securities available for sale at December 31, 2011, by contractual maturity, are shown

below. The remaining contractual principal maturities do not consider prepayments. Remaining expected maturities will differ

from contractual maturities because borrowers may have the right to prepay.

At December 31, 2011

(In thousands) Amortized Cost Fair Value

Due in one year or less $ 100 $ 100

Due in 1-5 years 99 105

Due in 5-10 years 168 169

Due in after 10 years 2,233,192 2,322,214

No stated maturity 1,642 1,450

Total $2,235,201 $2,324,038

672011 Form 10-K