TCF Bank 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

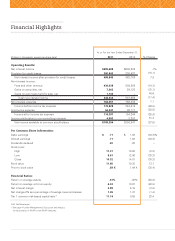

Non-performing assets declined

steadily throughout 2011, down $53.1

million, or 10.9 percent, from 2010 and

have now decreased five consecutive

quarters. This decline in non-performing

assets is primarily due to decreases in

commercial and leasing and equipment

finance non-accrual loans and leases.

Despite the continued economic stress

on unemployment and home values,

we saw some stabilization in consumer

real estate delinquencies. To help our

customers avoid home foreclosure, TCF

has continued its program of providing

loan modifications which are accounted

for as troubled debt restructurings

(TDRs). The TDRs extend payment

dates, reduce interest rates and/or

reduce payment amounts for a term

of up to five years. These TDRs are

underwritten individually. Our goal is

to extend these TDRs to customers who

can make a payment and truly want to

stay in their homes.

At December 31, 2011, TCF held $433.1

million of accruing modified consumer

TDRs, up 28.4 percent from 2010, with

a weighted average interest rate of

3.7 percent. The TDR reserves are

based on the present value of expected

cash flows, or 13.5 percent, with a

fourth quarter annualized net charge-off

rate of 6.5 percent. To date, these TDRs

are performing as expected and have

proven to be an effective way to help

mitigate losses.

TCF’s Wholesale Banking division saw

some credit stabilization throughout

2011. Commercial net charge-offs and

provision tend to be lumpy as credits

are worked out, especially in this

challenging workout environment.

Overall, our specialty finance loans and

leases continue to perform very well.

We continue to closely monitor our

wholesale customers, and in particular,

those customers in distressed indus-

tries and geographies. Our relationship

banking strategy provided us with the

ability to effectively work out many

distressed loans. Wholesale Banking

continues to be a very profitable,

well-managed and highly diversified

segment.

Real estate owned properties decreased

throughout 2011. This was an encour-

aging sign as the length of time in the

foreclosure process continues to be

lengthy. At December 31, 2011, TCF

owned 465 consumer real estate

properties and 33 commercial real

estate properties, compared with

520 and 28 properties, respectively,

at December 31, 2010.

At December 31, 2011, TCF’s allowance

for loan and lease losses totaled $255.7

million, or 1.81 percent of loans and

leases, a decrease of $10.1 million from

December 31, 2010. The decrease in

allowance for loan and lease losses

was primarily due to charge-offs of

commercial loans during the first

quarter of 2011 that had previously been

specifically reserved for. TCF’s provision

for credit losses of $200.8 million

decreased 15.1 percent from last year.

Overall, we saw some good signs of

credit stabilization in 2011, not the least

of which was the consistent decline in

non-performing assets. That being said,

we still experienced elevated levels of

credit losses and delinquencies due to

the persistent economic conditions.

We are encouraged by the trends and

feel we are on the right track, but

ultimate success will only occur when

the economy gets back on track.

072011 Annual Report

1110090807

.65%

Percent

1.29%

1.68%

1.80%

1.81%

Allowance for Loan & Lease Losses

Net Charge-Offs

Net Charge-Offs & Allowance

for Loan & Lease Losses

Percent

1110090807

$106

$234

$402

$486

$433

Non-Performing Assets

Millions of Dollars