TCF Bank 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Asset Growth and Diversification

As a result of competition from large

national banks in our markets, it has

become more difficult for regional

banks to continue to add high-quality

loans and leases within a regional

footprint. To be successful, regional

banks must be able to make loans on

a national platform. As a result, over

the last several years TCF has begun

shifting its lending focus toward its

already successful national niche

lending programs. These national

platforms include equipment finance,

inventory finance, mortgage lending

and now auto finance. In 2011, TCF

announced an agreement to provide

inventory financing to the dealers of

Bombardier Recreational Products, Inc.

(BRP) in the U.S. and Canada as well as

an acquisition of Gateway One Lending

& Finance, Inc. (Gateway One), an

indirect auto finance company head-

quartered in California. While these

new programs will result in additional

operational risks, I am confident that

with the extensive due diligence

completed, their experienced manage-

ment teams, and TCF’s successful track

record of integrating and operating

national specialty finance programs,

we will be able to manage these risks.

These high-quality, secured lending

programs will provide TCF with an

avenue for growth in 2012. These new

programs will be a great complement

to our current specialty finance

portfolio and accretive to our business,

all while staying true to our conserva-

tive lending philosophy.

Functionally Organized Management

Structure As a result of the evolution

taking place at TCF, it was necessary to

reevaluate the responsibilities of our

experienced executive management

team to more efficiently manage and

implement strategies moving forward.

Our new functionally organized

management structure will allow us to

better manage our four key initiatives:

1) Enterprise Risk Management,

2) Lending, 3) Funding and 4) Corporate

Development. This structure is well

suited to both protect and increase

shareholder value into the future.

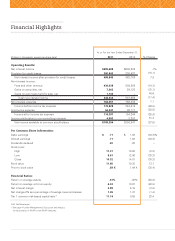

• TCF continued its consistency of

profitability in 2011, earning $109.4

million, down 28 percent from 2010.

Diluted earnings per common share

was $.71. These results remain below

TCF’s historical performance while

we continue to operate in a difficult

economic and regulatory environment.

With the continued evolution of TCF

and a slowly improving economy, I

look forward to improving these results.

• TCF’s net interest margin was 3.99

percent for the full year of 2011, down

16 basis points from the full year of

2010. In 2011, we continued to take

actions to increase the asset sensitivity

of the balance sheet, such as changing

the mix of fixed- and variable-rate

loans, in anticipation of rising interest

rates. Despite recent guidance from the

Federal Reserve suggesting rates will

likely not rise until late 2014, rates will

eventually rise and we will be ready to

take advantage when they do. In the

meantime, with our increased focus on

national specialty finance programs, we

have laid the groundwork for significant

growth in our higher-yielding portfolios.

Overall, TCF’s net interest margin

continues to be strong when compared

to the Top 50 Banks.

032011 Annual Report

Diluted Earnings Per

Common Share

Dollars

1110090807

$2.13

Dollars

$.88

$.60

$1.08

$.71

Diluted EPS

Dividends Paid

Net Interest Margin

Percent

1110090807

3.94%

3.91%

3.87%

4.15%

3.99%