TCF Bank 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

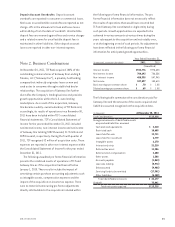

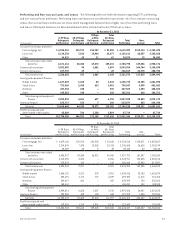

All of Gateway One’s loans held for investment had

evidence of deteriorated credit quality. The goodwill of

$73 million arising from the acquisition consists largely of

expected incremental balance sheet and fee growth and

cross selling opportunities. The goodwill was assigned to TCF’s

Wholesale Banking segment. None of the goodwill recognized

is expected to be deductible for income tax purposes.

Pursuant to the terms of the acquisition, three key

members of Gateway One’s management team acquired

shares of TCF common stock in the aggregate value of

$2.6 million with proceeds received by them from the

acquisition. These shares of TCF common stock will be

retained by a trustee for three years pursuant to the terms

of custodial agreements entered into between the trustee,

TCF and each individual. Ownership of these shares will

be forfeited to TCF if during the three year period the

individual terminates his employment with TCF without

cause, or TCF terminates their employment for cause, and

has been accounted for separately from the acquisition.

The value of these shares has been recorded within other

assets and will be recognized as compensation expense

ratably throughout the duration of the three-year period.

In addition, TCF provided Gateway One $10 million in interim

funding prior to the acquisition to facilitate its closing in a

timely manner. This loan was executed at prevailing market

pricing and terms.

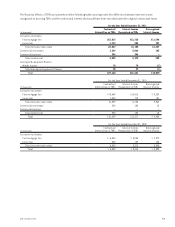

Note 3. Cash and Due from Banks

At December 31, 2011, TCF was required by Federal

Reserve regulations to maintain reserves of $42.1 million

in cash on hand or at the Federal Reserve.

TCF maintains cash balances that are restricted as

to their use in accordance with certain contractual

agreements related to the sale and servicing of auto loans.

Cash proceeds from loans serviced for third parties are

held in restricted accounts until remitted. TCF also retains

restricted cash balances for potential loss recourse on

certain sold auto loans. Restricted cash totaling $17.5

million was included within cash and due from banks at

December 31, 2011.

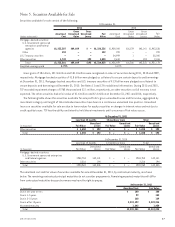

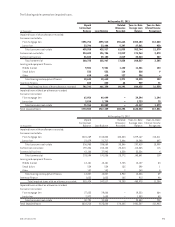

Note 4. Investments

The carrying values of investments consist of the following.

At December 31,

(In thousands) 2011 2010

Federal Home Loan Bank stock, at cost $119,086 $141,516

Federal Reserve Bank stock, at cost 31,711 30,684

Other 6,983 7,568

Total investments $157,780 $179,768

The investments in Federal Home Loan Bank (“FHLB”)

stock are required investments related to TCF’s current

borrowings from the FHLB Des Moines. FHLBs obtain their

funding primarily through issuance of consolidated

obligations of the FHLB system. The U.S. Government does

not guarantee these obligations, and each of the 12 FHLBs

are generally jointly and severally liable for repayment

of each other’s debt. Therefore, TCF’s investments in

these banks could be adversely impacted by the financial

operations of the FHLBs and actions of their regulator,

the Federal Housing Finance Agency. Other investments

primarily consist of non-traded mortgage-backed securities

and other bonds which qualify for investment credit under

the Community Reinvestment Act.

During 2011, TCF recorded an impairment charge of

$16 thousand on other investments, which had a carrying

value of $7 million at December 31, 2011, as full recovery

is not expected. During 2010, TCF recorded an impairment

charge of $241 thousand on other investments, which had a

carrying value of $7.6 million at December 31, 2010.

The carrying values and yields on investments at

December 31, 2011, by contractual maturity, are shown below.

(Dollars in thousands)

Carrying

Value Yield

Due in one year or less $ – –%

Due in 1-5 years 700 2.71

Due in 5-10 years 2,000 3.25

Due after 10 years 4,283 5.01

No stated maturity 150,797 2.84

Total $157,780 2.90%

66 TCF Financial Corporation and Subsidiaries