TCF Bank 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

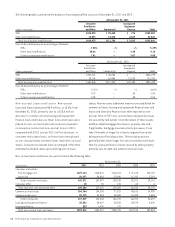

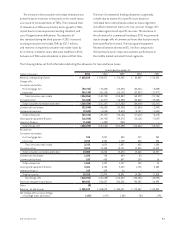

Consumer real estate net charge-offs during 2011

increased $23.3 million from 2010, including Illinois where

economic conditions are lagging other TCF markets and

where foreclosure times are longer, thus exposing TCF to

continued losses caused by declining home values. TCF’s

consumer real estate charge-off policy was recently

modified to require an increase in the frequency of

valuations after loans are moved to non-accrual status

until clear title is received. While the initial impact of the

policy change accelerated the timing of charge-offs on

non-accrual consumer real estate loans by $2.2 million

in the third quarter of 2011, it had no impact on TCF’s

provision for credit losses or net income, since these

losses were previously provided for in the allowance

for loan and lease losses. During 2011, commercial net

charge-offs decreased $7.3 million from 2010, primarily due

to decreased net charge-offs on office buildings and land

development. Leasing and equipment finance net charge-

offs in 2011 decreased $18.1 million from 2010, primarily

due to decreases in the middle market and small ticket

segments, as customer performance continued to improve

in these areas.

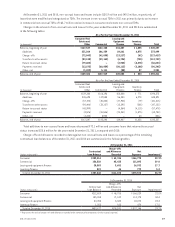

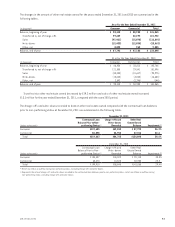

Other Real Estate Owned and Repossessed and

Returned Equipment Other real estate owned and

repossessed and returned equipment are summarized in

the following table.

Year Ended December 31,

(In thousands) 2011 2010 2009 2008 2007

Other real estate owned (1):

Consumer real estate $ 87,792 $ 90,115 $ 66,956 $38,632 $28,752

Commercial real estate 47,106 50,950 38,812 23,033 17,013

Total other real estate owned 134,898 141,065 105,768 61,665 45,765

Repossessed and returned equipment 4,758 8,325 17,166 10,927 2,292

Total other real estate owned

and repossessed and returned equipment $139,656 $149,390 $122,934 $72,592 $48,057

(1) Includes properties owned and foreclosed properties subject to redemption.

Other real estate owned is recorded at the lower of

cost or fair value less estimated costs to sell the property.

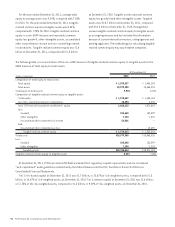

At December 31, 2011, TCF owned 465 consumer real

estate properties, a decrease of 55 from 2010, due to the

sale of 1,077 properties exceeding the addition of 1,022

properties. The average length of time to sell consumer

real estate properties during 2011 was 6.1 months from

the date they were classified as other real estate owned.

The consumer real estate portfolio is secured by a total

of 83,761 properties of which 723, or .86%, were owned or

foreclosed properties subject to redemption and included

within other real estate owned as of December 31, 2011.

This compares with 813, or .94%, owned or in the process of

foreclosure and included within other real estate owned as

of December 31, 2010.

42 TCF Financial Corporation and Subsidiaries