TCF Bank 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

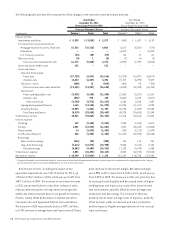

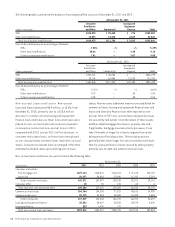

At December 31, 2011, 74% of TCF’s consumer real estate

loan balance consisted of closed-end loans, compared with

75% at December 31, 2010. TCF’s closed-end consumer real

estate loans require payments of principal and interest

over a fixed term. The average home value, which is based

on original values securing the loans and lines of credit in

this portfolio, was $258 thousand as of December 31, 2011.

Substantially all of TCF’s consumer real estate loans are in

TCF’s primary banking markets. TCF’s consumer real estate

lines of credit require regular payments of interest and do

not require regular payments of principal. The average Fair

Isaac Corporation (“FICO”) credit score at loan origination

for the retail lending portfolio was 727 as of December 31,

2011 and 726 as of December 31, 2010. As part of TCF’s

credit risk monitoring, TCF obtains updated FICO score

information quarterly. The average updated FICO score for

the retail lending portfolio was 727 at December 31, 2011,

compared with 725 at December 31, 2010.

TCF’s consumer real estate underwriting standards

are intended to produce adequately secured loans to

customers with good credit scores at the origination date.

Beginning in 2008, TCF generally has not made new loans

in excess of 90% loan-to-value (LTV) at origination. TCF

does not have any subprime lending programs and did not

originate 2/28 adjustable-rate mortgages (ARM) or Option

ARM loans. TCF also has not originated consumer real estate

loans with multiple payment options or loans with “teaser”

interest rates. Although TCF does not have any programs

that target subprime borrowers, in the normal course of

lending to customers, loans at lower LTV ratios have been

originated to borrowers with FICO scores below 620. At

December 31, 2011, 26% of the consumer real estate loan

balance had been originated since January 1, 2009, with net

charge-offs of .20%. TCF’s consumer real estate portfolio is

subject to the risk of falling home values and to the general

economic environment, particularly unemployment.

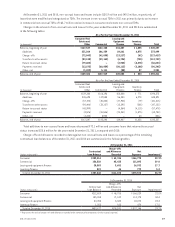

At December 31, 2011, total consumer real estate lines

of credit outstanding were $2.1 billion, down from $2.2

billion at December 31, 2010. Outstanding balances on

consumer real estate lines of credit were 61% of total lines

of credit at both December 31, 2011 and 2010.

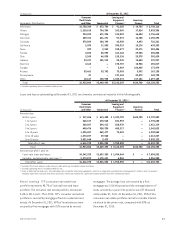

Commercial Banking Commercial real estate

loans decreased $129.5 million in 2011 to $3.2 billion

at December 31, 2011. Variable- and adjustable-rate

loans represented 42% of commercial real estate loans

outstanding at December 31, 2011. Commercial business

loans decreased $67.2 million in 2011 to $250.8 million

at December 31, 2011. Decreases in commercial loan

balances were primarily due to higher levels of payments

in excess of new origination volume. With a focus on

secured lending, approximately 99% of TCF’s commercial

real estate and commercial business loans were secured

either by properties or other business assets at December

31, 2011. At December 31, 2011, approximately 93% of

TCF’s commercial real estate loan portfolio was secured by

properties located in its primary banking markets.

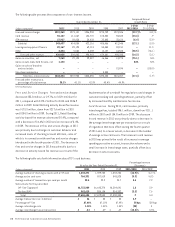

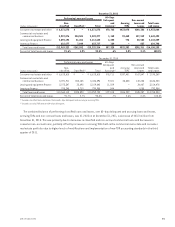

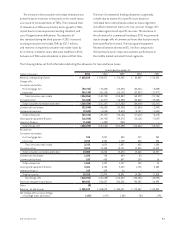

The following table summarizes TCF’s commercial real estate loan portfolio by property and loan type.

At December 31,

2011 2010

(Dollars in thousands)

Number

of Loans Permanent

Construction

and

Development Total

Number

of Loans Permanent

Construction

and

Development Total

Apartments 797 $ 861,504 $ 54,379 $ 915,883 716 $ 754,915 $ 20,338 $ 775,253

Retail services (1) 441 793,515 5,529 799,044 463 865,784 11,767 877,551

Office buildings 232 508,330 23,886 532,216 256 564,631 32,851 597,482

Warehouse/industrial buildings 238 395,188 12,946 408,134 262 459,904 10,475 470,379

Hotels and motels 39 205,697 6 205,703 41 203,794 28,387 232,181

Health care facilities 24 126,136 19,221 145,357 35 111,543 24,961 136,504

Residential home builders 41 31,540 17,890 49,430 31 32,071 19,810 51,881

Other 97 117,578 25,353 142,931 119 133,195 53,790 186,985

Total 1,909 $3,039,488 $159,210 $3,198,698 1,923 $3,125,837 $202,379 $3,328,216

(1) Primarily retail shopping centers and stores, convenience stores, gas stations, restaurants and auto dealerships.

32 TCF Financial Corporation and Subsidiaries