TCF Bank 2011 Annual Report Download - page 39

Download and view the complete annual report

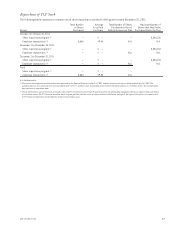

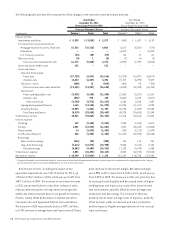

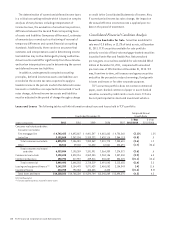

Please find page 39 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Segment Results RETAIL BANKING — Retail

Banking, consisting of branch banking and retail lending,

reported net income of $49.6 million for 2011, down from

$93 million in 2010 primarily due to decreased fee income in

branch banking. Retail Banking net interest income for 2011

was $448.1 million, up 1.2% from $443 million for 2010.

The Retail Banking provision for credit losses totaled

$162.2 million in 2011, up 15.3% from $140.6 million

in 2010. This increase was primarily due to higher net

charge-offs and troubled debt restructuring (“TDR”)

reserves for consumer real estate loans. Refer to “Item

7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations — Consolidated Income

Statement Analysis — Provision for Credit Losses” for

further discussion.

Retail Banking non-interest income totaled $337.7

million in 2011, compared with $409.6 million in 2010. Fees

and service charges were $213 million for 2011, down 20.4%

from $267.5 million in 2010. Card revenues were $96.1

million for 2011, down 13.4% from $111 million in 2010.

The decrease in card revenues was primarily attributable

to debit card interchange regulation which took effect on

October 1, 2011. See “Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations

— Consolidated Income Statement Analysis — Non-Interest

Income” for further discussion.

Retail Banking non-interest expense totaled $545.3

million in 2011, down 3.1% from $562.8 million in 2010. The

decrease was primarily due to decreases in compensation

and employee benefit expenses and occupancy expenses as

a result of certain branch closures during 2011.

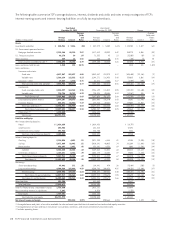

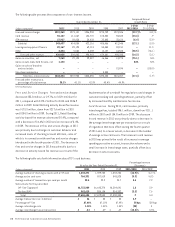

WHOLESALE BANKING — Wholesale Banking, consisting

of commercial banking, leasing and equipment finance,

inventory finance and auto finance, reported net income of

$76.5 million for 2011, up 93.4% from $39.5 million in 2010.

Net interest income for 2011 was $274.7 million, up 8.5%

from $253.1 million in 2010, as a result of increased income

from inventory finance loans primarily due to average

balance growth of $179 million, partially offset by decreases

in leasing and equipment finance and commercial real

estate portfolio balances and average yields.

The provision for credit losses for Wholesale Banking

totaled $36.1 million in 2011, down from $94 million in

2010. The decrease in the provision for credit losses from

2010 was primarily due to decreased net charge-offs and

decreased non-accrual loans in commercial lending and

leasing and equipment finance.

Wholesale Banking non-interest income totaled $98.7

million in 2011, essentially flat from 2010. Decreases in

operating lease revenues and floorplan inventory inspection

fees were offset by increases resulting from gains on

sales-type lease activity, gains on sales of auto loans and

increases in commercial loan prepayment fees.

Wholesale Banking non-interest expense totaled $208.7

million in 2011, up $17.4 million from $191.3 million in

2010, primarily as a result of increased FDIC insurance

premiums resulting from changes in the FDIC insurance

rate calculations for banks over $10 billion in total assets,

increased valuation write-downs of commercial real

estate properties owned, and the ramp-up of expenses

related to the exclusive financing program for Bombardier

Recreational Products (“BRP”) that will begin funding

early in 2012, partially offset by decreased operating lease

depreciation due to the reduction in the operating lease

portion of the portfolio.

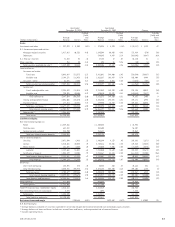

TREASURY SERVICES — Treasury Services reported a

net loss of $17 million in 2011, down from net income

of $16.2 million in 2010. The $33.2 million change was

primarily due to gains on sales of securities of $31.5 million

in 2010 compared with gains of $8 million in 2011, along

with the impact of increased asset liquidity and increased

asset sensitivity, partially offset by a lower average cost

of borrowing.

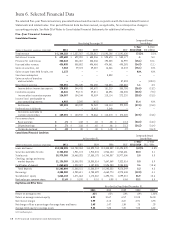

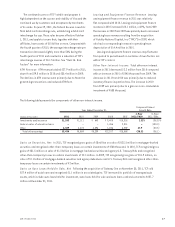

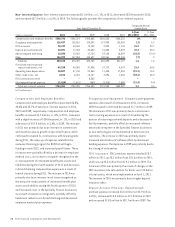

Consolidated Income Statement Analysis

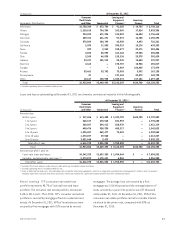

Net Interest Income Net interest income, the difference

between interest earned on loans and leases, investments

and other interest-earning assets (interest income), and

interest paid on deposits and borrowings (interest expense),

represented 61.2% of TCF’s total revenue in 2011, 56.5%

in 2010 and 54.6% in 2009. Net interest income divided by

average interest-earning assets is referred to as the net

interest margin, expressed as a percentage. Net interest

income and net interest margin are affected by changes

in prevailing short- and long-term interest rates, loan and

deposit pricing strategies and competitive conditions, the

volume and the mix of interest-earning assets and interest-

bearing liabilities, the level of non-performing assets, and

the impact of modified loans and leases.

212011 Form 10-K