TCF Bank 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

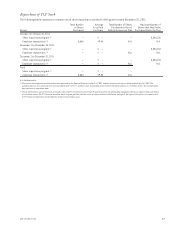

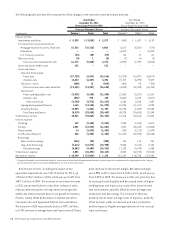

Total Return Performance

The following graph compares the cumulative total

stockholder return on TCF Stock over the last five fiscal

years with the cumulative total return of the Standard and

Poor’s 500 Stock Index, the SNL All Bank and Thrift Index,

and a TCF Financial-selected group of peer institutions

over the same period (assuming the investment of $100

in each index on December 31, 2006 and reinvestment of

all dividends).

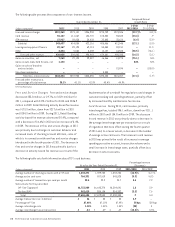

The New TCF Peer Group for 2012 consists of the publicly-

traded banks and thrifts with total assets ranging from

$10 billion to $50 billion as of December 31, 2011. This

is a change from TCF’s previously defined peer group

which consisted of 30 publicly-traded banks and thrifts,

15 immediately larger than and 15 immediately smaller

than TCF. TCF changed its peer group to align itself with

financial institutions that are similarly impacted by

recent regulatory and legislative changes because TCF

believes that the New Peer Group represents a more

relevant group of companies in the financial services

industry. The New and Old TCF Peer Groups are shown

below for comparison purposes.

TCF Stock Performance Chart

Total Return Performance

Index Value

TCF Financial Corporation S&P 500 Index

SNL Bank and Thrift Index(1)

12/31/1112/31/1012/31/0912/31/0812/31/0712/31/06

40

60

80

100

120

$140 New TCF Peer Group(2) Old TCF Peer Group(3)

Period Ending

Index 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11

TCF Financial Corporation 100.00 67.96 55.03 56.49 62.23 44.01

SNL Bank and Thrift (1) 100.00 76.26 43.85 43.27 48.30 37.56

S&P 500 Index 100.00 105.49 66.46 84.05 96.71 98.76

New TCF Peer Group (2) 100.00 84.38 77.39 71.04 78.72 65.64

Old TCF Peer Group (3) 100.00 80.30 71.95 64.65 71.79 61.86

(1) Includes all major exchange (NYSE, NYSE Amex, NASDAQ) banks and thrifts in SNL’s coverage universe (476 companies as of December 31, 2011).

(2) The New TCF Peer Group consists of the publicly-traded banks and thrifts with total assets ranging from $10 billion to $50 billion as of December 31, 2011. The New TCF

Peer Group includes: Hudson City Bancorp, Inc.; New York Community Bancorp, Inc.; Popular, Inc.; First Niagara Financial Group, Inc.; First Republic Bank; People’s

United Financial, Inc.; Synovus Financial Corp.; BOK Financial Corporation; First Horizon National Corporation; City National Corporation; East West Bancorp, Inc.;

Associated Banc-Corp; First Citizens BancShares, Inc.; Commerce Bancshares, Inc.; Cullen/Frost Bankers, Inc.; SVB Financial Group; Hancock Holding Company; Webster

Financial Corporation; Astoria Financial Corporation; Fulton Financial Corporation; Wintrust Financial Corporation; Susquehanna Bancshares, Inc.; Signature Bank; First

Merit Corporation; Valley National Bancorp; Bank of Hawaii Corporation; Washington Federal, Inc.; Flagstar Bancorp, Inc.; UMB Financial Corporation; First BanCorp.;

BancorpSouth, Inc.; PrivateBancorp, Inc.; IBERIABANK Corporation; International Bancshares Corporation; Umpqua Holdings Corporation; BankUnited, Inc.; TFS Financial

Corporation (MHC); Investors Bancorp, Inc. (MHC); and Cathay General Bancorp.

(3) The Old TCF Peer Group consisted of 30 publicly-traded banks and thrifts, 15 immediately larger than and 15 immediately smaller than TCF Financial Corporation in total

assets as of September 30, 2011. The Old Peer Group included: Popular, Inc.; First Niagara Financial Group, Inc.; Synovus Financial Corporation; People’s United Financial, Inc.;

First Republic Bank; First Horizon National Corporation; BOK Financial Corporation; City National Corporation; Associated Banc-Corp; East West Bancorp, Inc.; First Citizens

BancShares, Inc.; Commerce Bancshares, Inc.; Cullen/Frost Bankers, Inc.; Hancock Holding Company; SVB Financial Group; Webster Financial Corporation; Astoria Financial

Corporation; Fulton Financial Corporation; Wintrust Financial Corporation; FirstMerit Corporation; Susquehanna Bancshares, Inc.; Valley National Bancorp; Signature Bank;

Flagstar Bancorp, Inc.; First BanCorp.; Washington Federal, Inc.; Bank of Hawaii Corporation; BancorpSouth, Inc.; UMB Financial Corporation; and PrivateBancorp, Inc.

Source: SNL Financial LC and Standard & Poor’s ©2012

16 TCF Financial Corporation and Subsidiaries