TCF Bank 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recent Accounting Developments

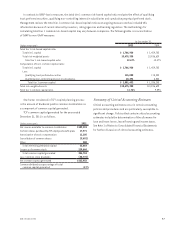

On April 29, 2011, the FASB issued Accounting Standards

Update (“ASU”) No. 2011-03, Reconsideration of Effective

Control for Repurchase Agreements (Topic 860), which

removes the collateral maintenance provision that is

currently required when determining whether a transfer of a

financial instrument is accounted for as a sale or a secured

borrowing. The adoption of the ASU will be required for TCF’s

Quarterly Report on Form 10-Q for the first quarter of 2012

and is not expected to have a material impact on TCF.

On May 12, 2011, the FASB issued ASU No. 2011-04,

Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and IFRS

(Topic 820), which is a joint effort between the FASB and

International Accounting Standards Board (“IASB”) to

converge fair value measurement and disclosure guidance.

The ASU permits measuring financial assets and liabilities

on a net credit risk basis, if certain criteria are met. The ASU

also increases disclosure surrounding company determined

fair values for level 3 financial instruments and also requires

the fair value hierarchy disclosure of financial assets

and liabilities that are not recognized at fair value in the

statement of financial position but included in disclosures

at fair value. The adoption of the ASU will be required for

TCF’s Quarterly Report on Form 10-Q for the first quarter of

2012 and is not expected to have a material impact on TCF.

On June 16, 2011, the FASB issued ASU No. 2011-05,

Presentation of Comprehensive Income (Topic 220),

which requires companies to report total net income,

each component of comprehensive income including

reclassifications between net income and other

comprehensive income, and total comprehensive income

on the face of the income statement, or as two consecutive

statements. The components of comprehensive income will

not be changed, nor does the ASU affect how earnings per

share is calculated or reported. These amendments will be

reported retrospectively upon adoption. The adoption of

the ASU will be required for TCF’s Quarterly Report on Form

10-Q for the first quarter of 2012 and is not expected to

have a material impact on TCF.

On December 16, 2011, the FASB issued ASU No. 2011-11,

Disclosures about Offsetting Assets and Liabilities

(Topic 210), which requires companies that have financial

and derivative instruments subject to a master netting

agreement to disclose the gross amount of the financial

assets and liabilities, the amounts that are offset on

the balance sheet, the net amounts presented, and the

amounts subject to a master netting arrangement that are

not offset. The adoption of the ASU will be required for TCF’s

Quarterly Report on Form 10-Q for the first quarter of 2013

and is not expected to have a material impact on TCF.

On December 23, 2011, the FASB issued ASU No. 2011-12,

Deferral of the Effective Date for Amendments to the

Presentation of Reclassifications of Items out of Accumulated

Other Comprehensive Income in Accounting Standards Update

No. 2011-05 (Topic 220), which defers the requirement within

ASU No. 2011-05 to present the reclassification amounts from

other comprehensive income to net income as a separate

component on the income statement. The FASB has not yet

established a new effective date for these provisions. The

remaining requirements of ASU No. 2011-05 were not deferred.

Fourth Quarter Summary

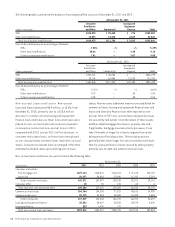

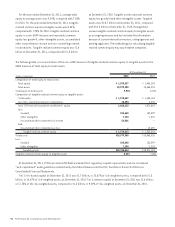

For the quarter ended December 31, 2011, TCF reported net

income of $16.4 million, compared with $33.9 million for

the quarter ended December 31, 2010. Diluted earnings

per common share was 10 cents for the quarter ended

December 31, 2011, compared with 24 cents for the quarter

ended December 31, 2010.

Net interest income was $173.4 million for the quarter

ended December 31, 2011, down $852 thousand, or .5%,

from the quarter ended December 31, 2010. The decrease

in net interest income was primarily due to the following

changes in loans and leases: reduced levels of higher

yielding fixed-rate consumer real estate loans and

decreases in leasing and equipment finance and commercial

real estate portfolio balances and average yields, partially

offset by reductions in average deposit rates. Net interest

margin for the quarter ended December 31, 2011 was 3.92%,

compared with 4.05% for the quarter ended December 31,

2010. The decrease in net interest margin was primarily due

to increased asset liquidity and decreased levels of higher

yielding loans and leases as a result of the lower interest

rate environment. These changes were partially offset by

a lower average cost of deposits and borrowings.

TCF provided $59.2 million for credit losses in the

quarter ended December 31, 2011, compared with $77.6

million in the quarter ended December 31, 2010. The

decrease was primarily due to decreased net charge-offs

and reserves in the commercial real estate and leasing

and equipment finance portfolios. For the quarter ended

December 31, 2011, net loan and lease charge-offs were

$57.9 million, or 1.63%, annualized, of average loans and

leases outstanding, compared with $64.9 million, or 1.75%,

annualized, of average loans and leases outstanding during

the quarter ended December 31, 2010. The decrease was

48 TCF Financial Corporation and Subsidiaries