TCF Bank 2011 Annual Report Download - page 47

Download and view the complete annual report

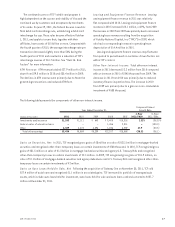

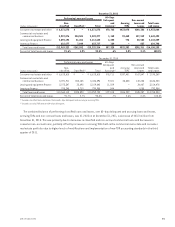

Please find page 47 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increase in 2011 was primarily due to changes in the account

premium programs beginning in April 2011, which increased

the premiums paid for each qualified account opening. The

decrease in 2010 was primarily due to revised marketing

strategies and lower checking account production. New

checking accounts increased 3.1% in 2011 compared with

2010 and decreased 37% in 2010 compared with 2009.

Advertising and Marketing Advertising and marketing

expenses totaled $10 million in 2011, compared to $13.1

million in 2010 and $17.1 million in 2009. The decrease

in 2011 was primarily due to the discontinuation of the

debit card rewards program in the third quarter of 2011 in

response to new federal regulation regarding debit card

interchange fees. The decrease in 2010 was primarily the

result of retail banking product strategies and a related

decrease in spending on media advertisements.

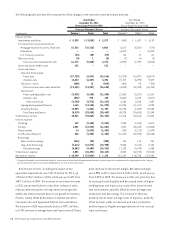

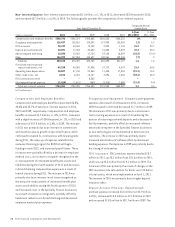

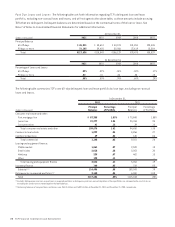

Other Non-Interest Expense Other non-interest

expense totaled $146.9 million in 2011, relatively flat

compared with 2010. Other non-interest expense totaled

$147.9 million in 2010, up $4.2 million from 2009, primarily

attributable to increased consulting costs related to the

administration of the Company’s Bank Secrecy Act program

and other legal costs related to the challenge of the Durbin

Amendment of the Dodd-Frank Act.

Foreclosed Real Estate and Repossessed Assets, Net

Foreclosed real estate and repossessed assets expense,

net totaled $49.2 million in 2011, compared to $40.4

million in 2010 and $31.9 million in 2009. The increase

in 2011 was primarily due to increased valuation write-

downs on commercial real estate properties. The increase

in 2010 was primarily due to an increase in the average

number of consumer real estate properties owned and the

associated expenses, continued valuation write-downs of

both consumer and commercial real estate properties, and

increased property tax expenses.

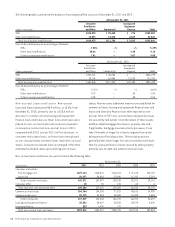

Operating Lease Depreciation Operating lease

depreciation totaled $30 million in 2011, down $7.1 million

from $37.1 million in 2010, which was up $14.7 million from

$22.4 million in 2009. The decrease in 2011 was primarily

due to the reduction in the operating lease portion of the

portfolio. The increase in 2010 was primarily due to the

acquisition of FNCI in 2009.

Other Credits Costs, Net Other credit costs, net is

comprised of consumer real estate loan pool insurance,

write-downs on carrying values of operating leases due to

customer defaults and reserve requirements for expected

losses on unfunded commitments. Other credit costs, net

totaled $2.8 million for 2011, down from $6 million in 2010,

which was down from $12.1 million in 2009. The decrease

in 2011 was primarily due to reduced premium related

expense on consumer real estate loan pool insurance. The

decrease in 2010 was primarily attributable to the reversal

of reserves on several unfunded commitments that were

closed and lower premium costs related to consumer real

estate loan pool insurance.

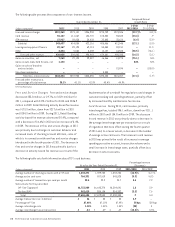

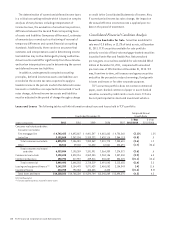

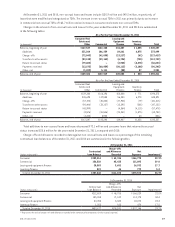

Visa Indemnification Expense TCF is a member of Visa

U.S.A. for issuance and processing of its card transactions.

As a member of Visa, TCF has an obligation to indemnify

Visa U.S.A. under its bylaws and Visa under a retrospective

responsibility plan, for contingent losses in connection

with certain covered litigation disclosed in Visa’s public

filings with the SEC based on its membership proportion. TCF

is not a party to the lawsuits brought against Visa U.S.A.

TCF’s membership proportion in Visa U.S.A. is .16234% at

December 31, 2011.

As of December 31, 2011, TCF held 308,219 Visa Inc.

Class B shares with no recorded value that are generally

restricted from sale, other than to other Class B share-

holders, and are subject to dilution as a result of TCF’s

indemnification obligation.

At December 31, 2011, TCF had no remaining Visa

contingent indemnification obligation. TCF’s indemnification

obligation for Visa’s covered litigation is a highly judgmental

estimate. TCF must rely on Visa’s public disclosures about

the covered litigation in making estimates of the Visa

contingent indemnification obligation.

Income Taxes Income tax expense represented 36.04% of

income before income tax expense during 2011, compared

with 36.89% and 34.67% in 2010 and 2009, respectively.

The lower effective income tax rate for 2011 as compared

to 2010 is primarily due to changes in state income tax

expense related to tax return filings. The lower effective

income tax rate for 2009 as compared to 2010 is primarily

due to significant favorable developments in uncertain tax

positions in 2009.

292011 Form 10-K