TCF Bank 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

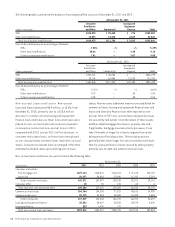

In contrast to GAAP-basis measures, the total tier 1 common risk-based capital ratio excludes the effect of qualifying

trust preferred securities, qualifying non-controlling interest in subsidiaries and cumulative perpetual preferred stock.

Management reviews the total tier 1 common risk-based capital ratio as an ongoing measure and has included this

information because of current interest by investors, rating agencies and banking regulators. The methodology for

calculating total tier 1 common risk-based capital may vary between companies. The following table is a reconciliation

of GAAP to non-GAAP measures.

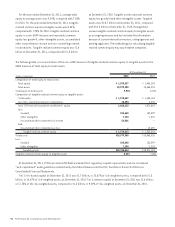

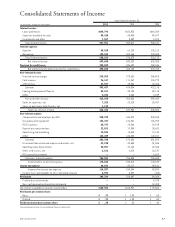

At December 31,

(Dollars in thousands) 2011 2010

Total tier 1 risk-based capital ratio:

Total tier 1 capital $ 1,706,926 $ 1,459,703

Total risk-weighted assets 13,475,330 13,936,629

Total tier 1 risk-based capital ratio 12.67% 10.47%

Computation of tier 1 common capital ratio:

Total tier 1 capital $ 1,706,926 $ 1,459,703

Less:

Qualifying trust preferred securities 115,000 115,000

Qualifying non-controlling interest in subsidiaries 10,494 8,500

Total tier 1 common capital $ 1,581,432 $ 1,336,203

Total risk-weighted assets $13,475,330 $13,936,629

Total tier 1 common capital ratio 11.74% 9.59%

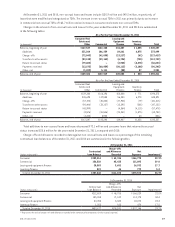

One factor considered in TCF’s capital planning process

is the amount of dividends paid to common stockholders as

a component of common capital generated.

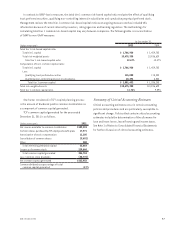

TCF’s common capital generated for the year ended

December 31, 2011 is as follows.

(Dollars in thousands) 2011

Net income available to common stockholders $109,394

Common shares purchased by TCF employee benefit plans 17,971

Amortization of stock compensation 11,105

Cancellation of common shares (3,692)

Other 280

Total internally generated capital 25,664

Issuance of common stock 219,666

Total common capital generated 354,724

Less: Common stock dividends (30,772)

Net common capital generated $323,952

Common dividend as a percentage of total

common capital generated 8.7%

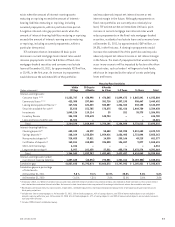

Summary of Critical Accounting Estimates

Critical accounting estimates occur in certain accounting

policies and procedures and are particularly susceptible to

significant change. Policies that contain critical accounting

estimates include the determination of the allowance for

loan and lease losses, lease financing and income taxes.

See Note 1 of Notes to Consolidated Financial Statements

for further discussion of critical accounting estimates.

472011 Form 10-K